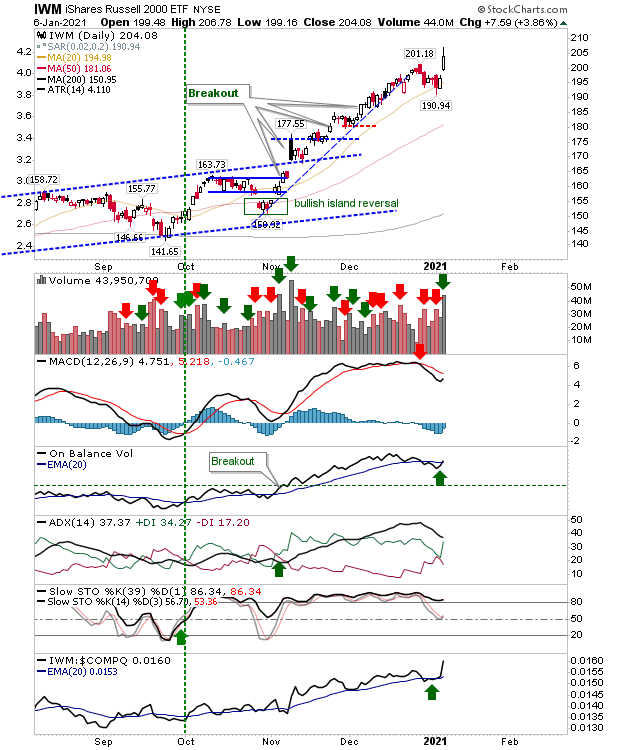

There was a strong close to last week with markets finishing at new highs. The Russell 2000 was a bit of an exception as it closed just a little down on Friday, but not before spiking at a high. The Russell 2000 ($IWM) did register as a distribution day on Friday, but the net effect was relatively minor compared to previous buying. Technicals are all net positive with relative performance still doing well against the Nasdaq and S&P. The index is 36% above its 200-day MA, where just 22% is enough to place it in the 99% area of historic price extremes; a move to mean reversion will happen soon.