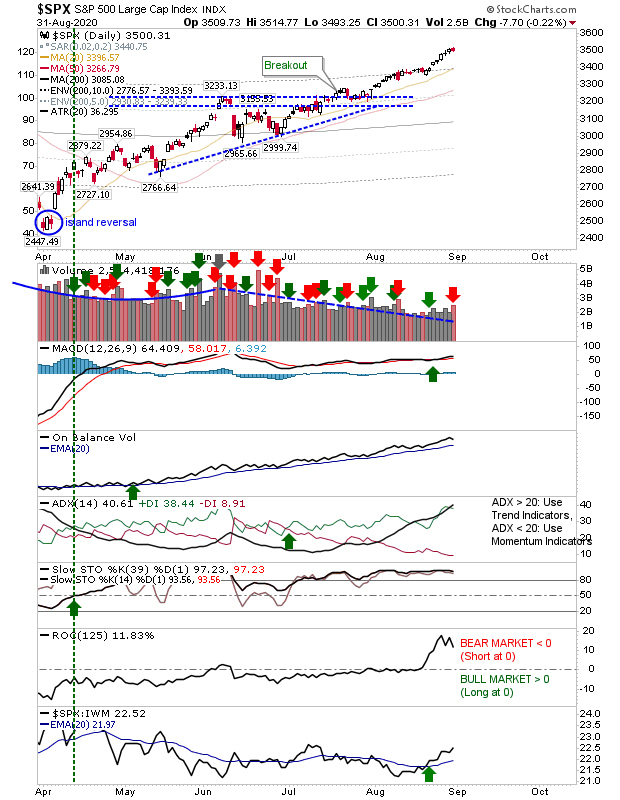

Sellers Step In As Moving Averages Hold

After days of small gains it only took two days to undo the buying for the majority of August before longs stepped in to recover things by Friday's close. The savior for indices were key moving averages - the 50-day MAs in particular - as traders complacent after easy gains received a bit of a jolt. This isn't a crash, nor necessarily the start of one, but we need to see what happens when indices become oversold and whether they can attract sufficient buyers to take indices out of this condition; if they can't, then the crash sirens will have more credence. The Nasdaq saw 'sell' triggers in the MACD and -DI/+DI, but stochastics require a few more days of weakness before they can be considered bearish, let alone, oversold. However, the 50-day MA offered a picture perfect support area for Friday's low.