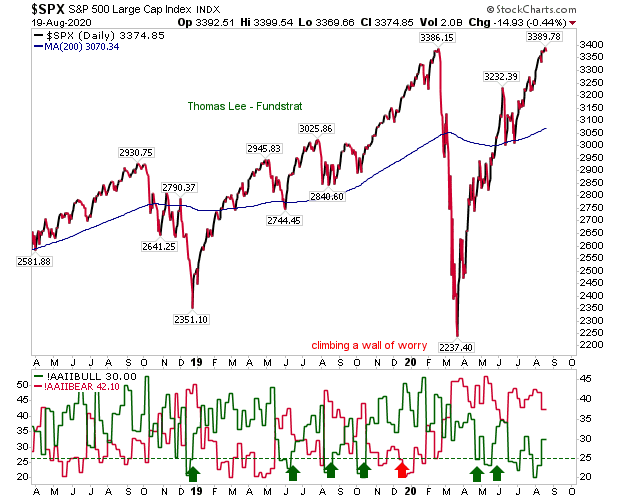

Markets are posting small gains which in themselves offer little, but over the course of days add up to a stealth rally. Indices remain above key moving averages, which runs in support of the market trend. Tags of 20-day and 50-day MAs have provided buyers an opportunity to buy the dips but for how long? The Nasdaq fell outside of its rising trendline in a slowing of this trend. The 20-day MA is still playing as support but it will take a test of the 50-day MA to assess how much real demand there is. One thing this stealth rally had me overlook was the overbought tracker - the index is in the 10% zone, which means the index has extended beyond 90% of prior price action relative to its 200-day MA dating back to 1971. So a top is closer than some might think.