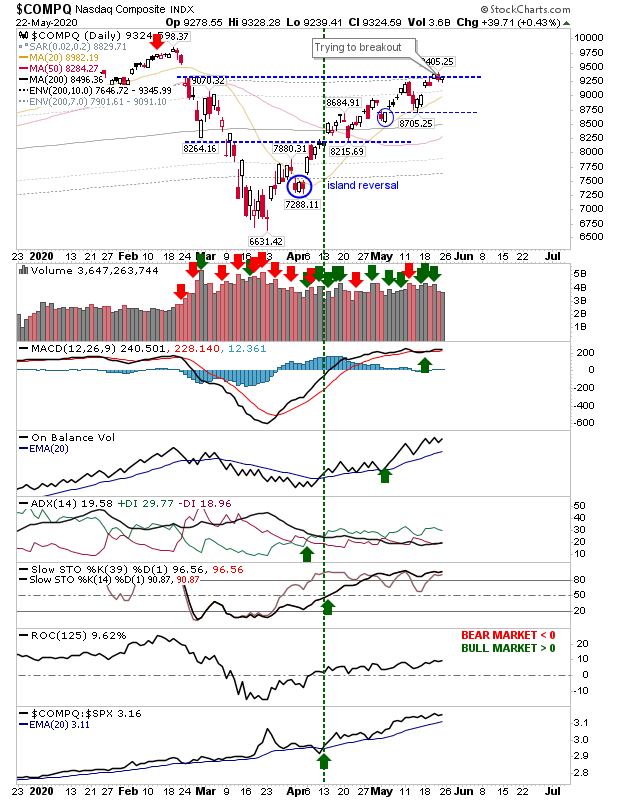

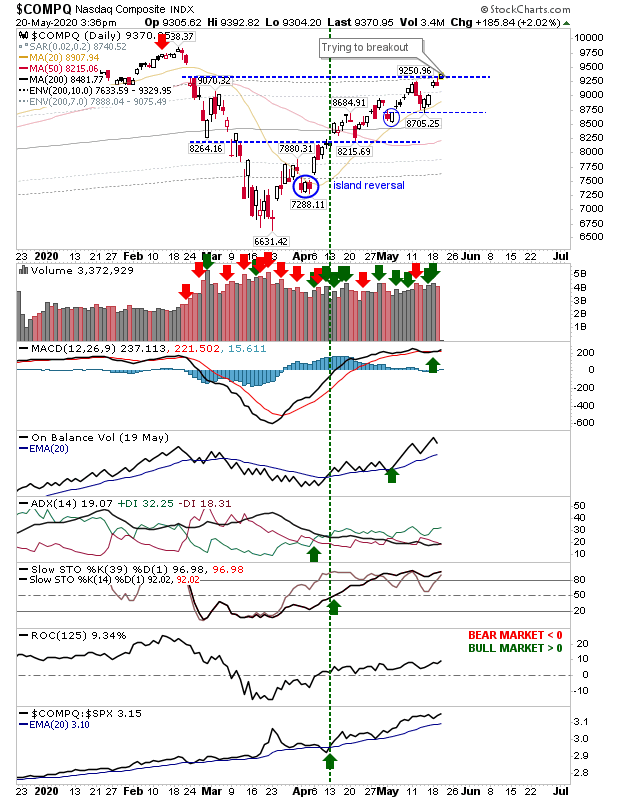

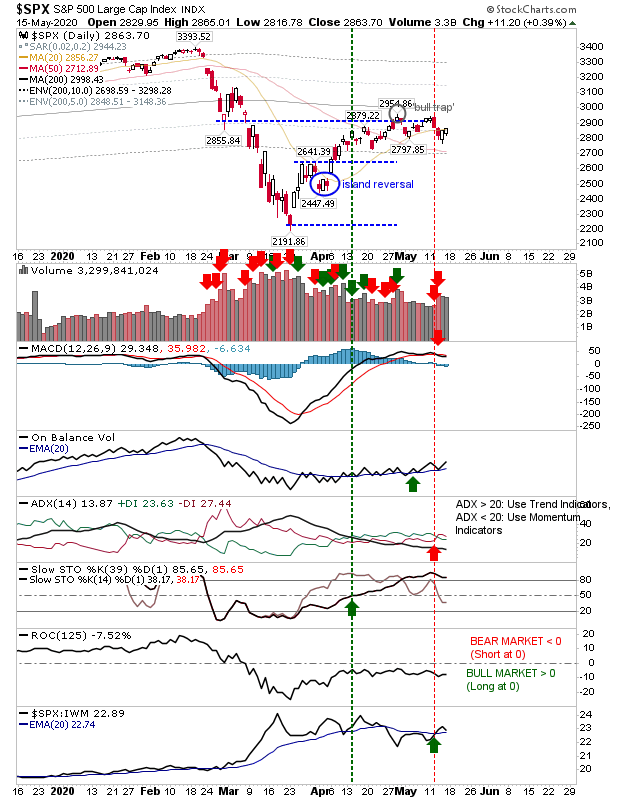

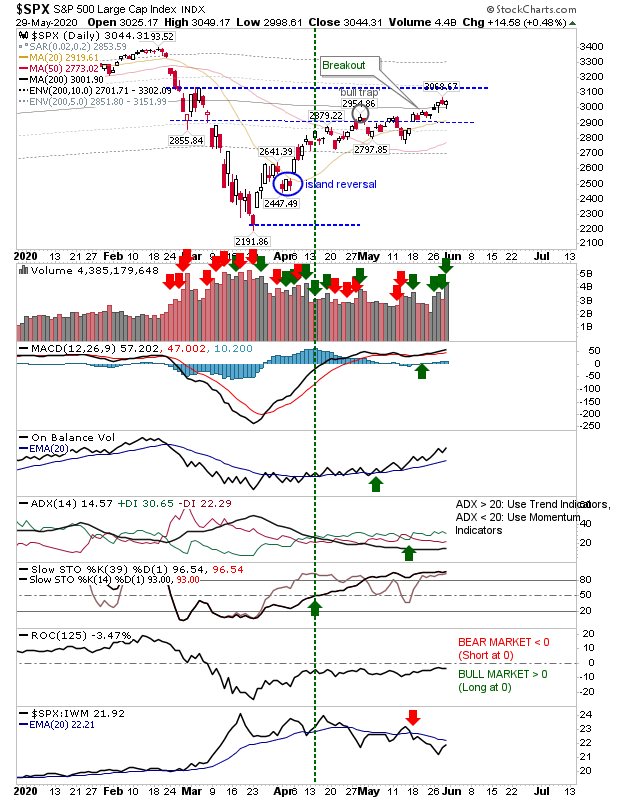

Strong finish on Friday for S&P and Nasdaq as Russell 2000 struggles.

The week closed strongly with volume rising in confirmed accumulation across indices. The S&P remained above its 200-day MA on increasing accumulation (rising On-Balance-Volume) as relative performance against the Russell 2000.and Nasdaq remained weak. The index remains on course to challenge the mini-swing high from February - a milestone already achieved by the Nasdaq.