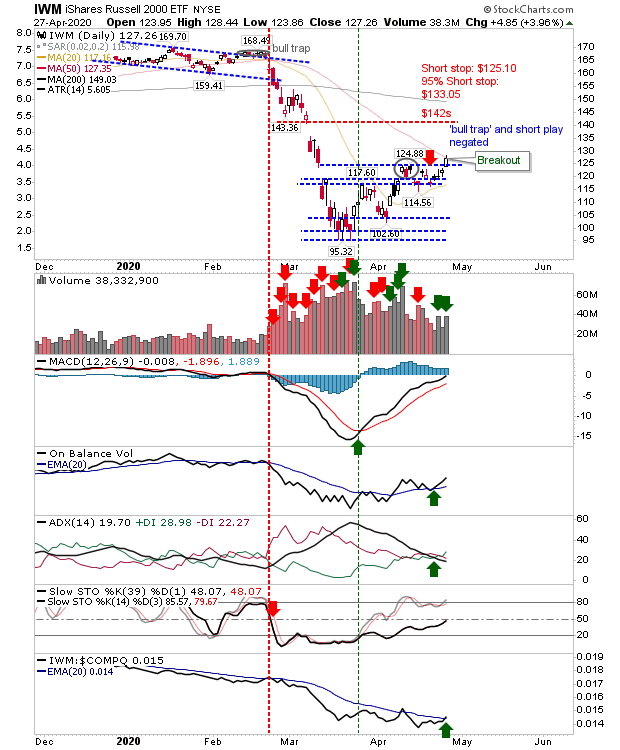

Nasdaq adds to breakout on light volume

Market action remained somewhat low key with only the Nasdaq trading any action of note. The Nasdaq is fast approaching next resistance level of the February(!) breakdown gap - this will probably the last point of attack for shorts as going beyond this will fill (and therefore, negate) the breakdown gap. Trading volume for the index was well down on yesterday.