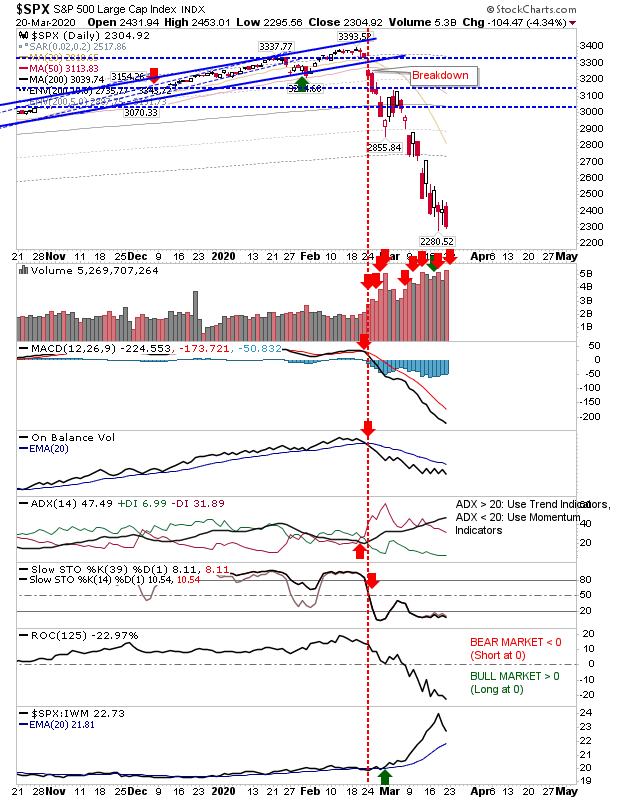

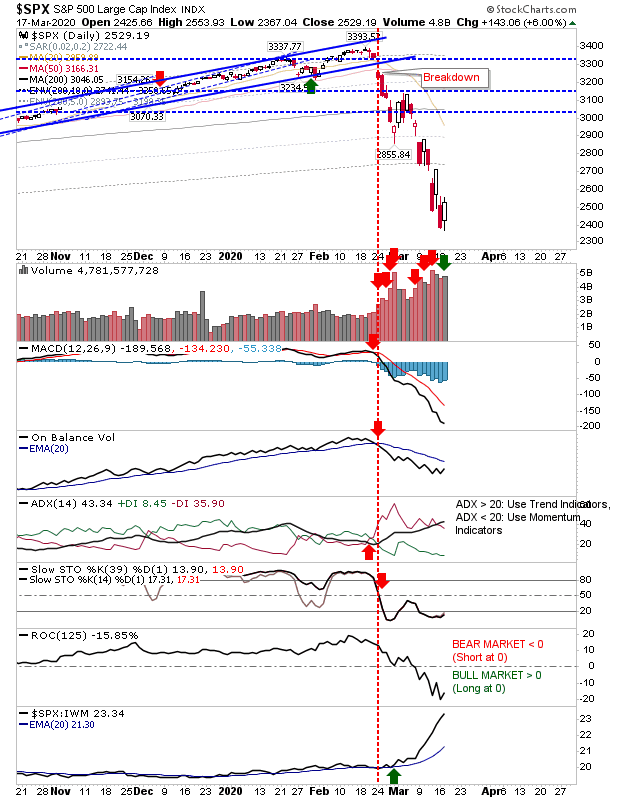

Russell 2000 and Nasdaq Continue to Seek A Bottom

While the S&P took another, smaller, step lower. Both the Nasdaq and Russell 2000 seem to have stabilized around last week's trading range. Today's volume was lighter than Friday but remained very heavy overall. Traders willing to use the current low as a risk measure may find enough room for a relief-rally trade, but it won't be one for the feint of heart, and could easily be stopped out tomorrow. In the case of the Russell 2000 ETF, $IWM, the trade stop is below $95.69, but with an ATR of 7.84 you would ideally be looking at a stop closer to $83s to allow for volatility - making the typical risk:reward worthless. So, with that caveat, buyers want to be close to the exit button.