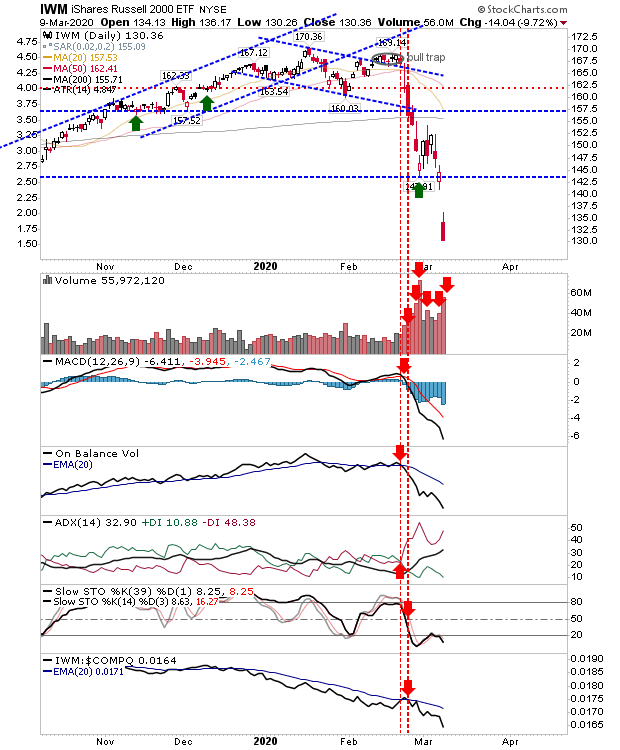

Markets Bounce (Again) in Wide Range Day

It has been so long since we have made trading days like the ones we have had the past couple of weeks. Friday was no exception as markets posted 6-9% day gains following comparable losses the day before. One only has to look at the price congestion from earlier in the year and the latter part of 2019 to see how weeks worth of action is now playing out in the course of one day. Nobody knows to what extent Covid 19 will hit this year's earnings, or what the long term effects on consumer demand, supply chain security, and the gig economy will be, but as an acute infection with a relatively low mortality rate (thankfully, this is not Ebola), the recovery should work through quick enough. Aside from the morbidity factors of the disease, the impacts on loss of earnings for gig economy workers will be significant and it will be interesting to see what (if any?) changes are made in the employment conditions for such workers and other vulnerable employees in scenarios like these. And much