Dead Cat Bounce in the Trump Slump?

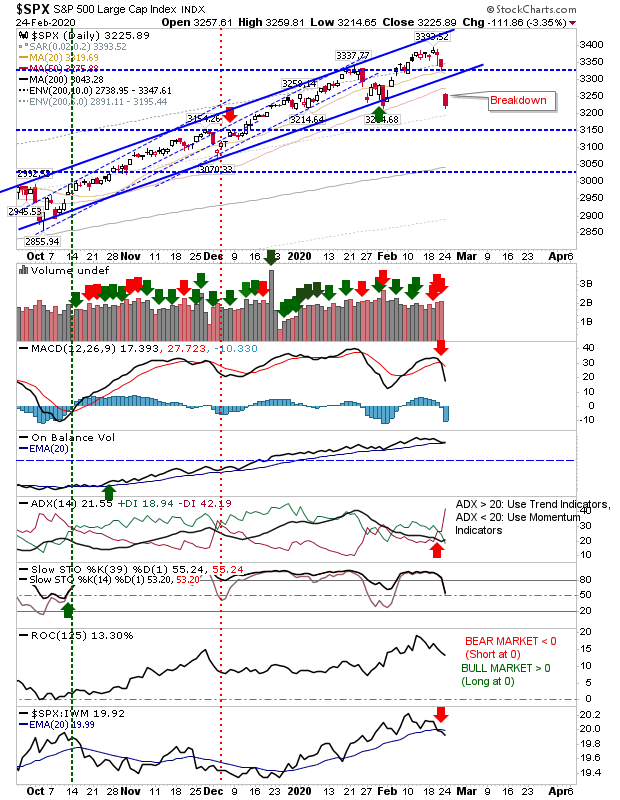

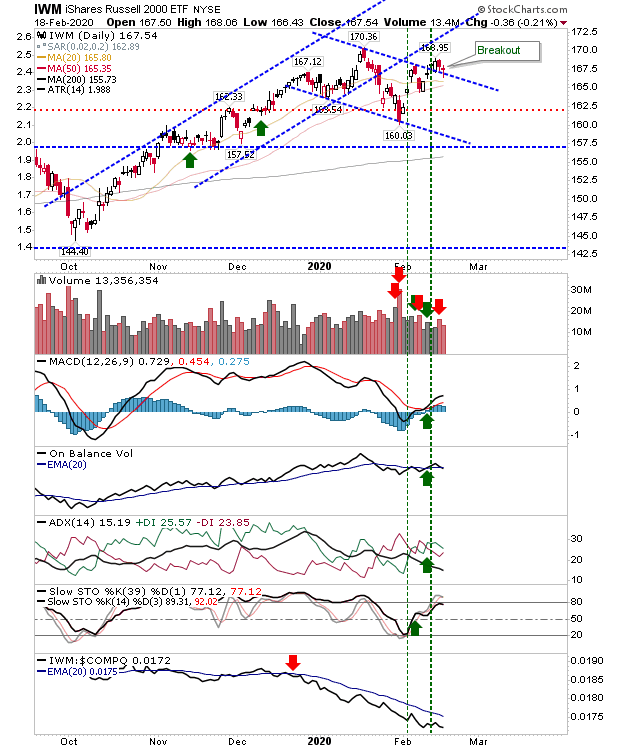

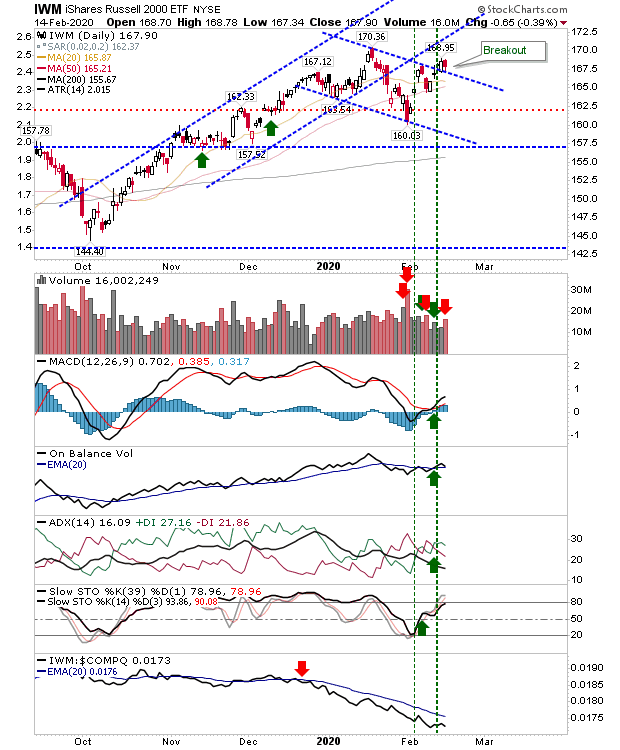

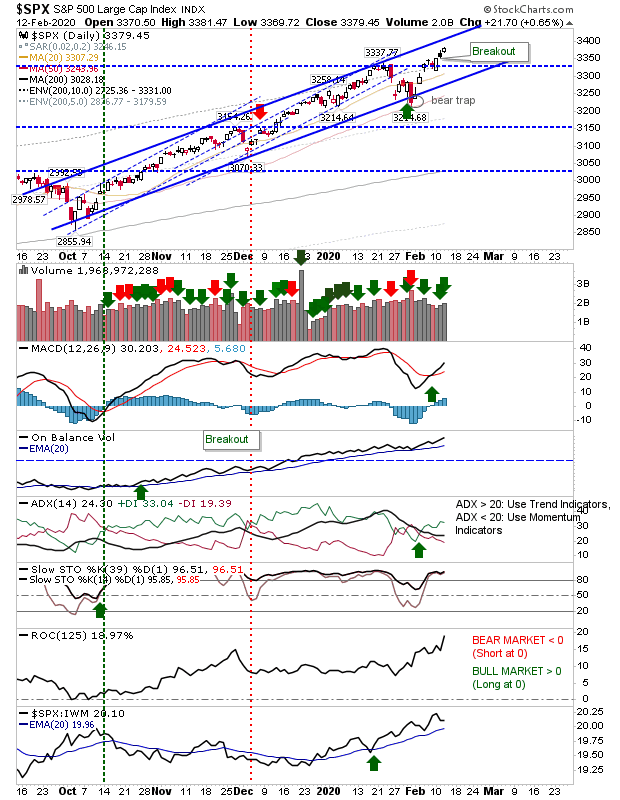

These big reaction moves always seem to happen when I'm afk. Anyway, markets are attempting to price what impact the Coronoavirus will have in both the short term and long term, but after 10% declines we now have the dead cat bounce effect. I don't expect the bounce to last with a retest of recent lows likely, but this test could evolve into a slow decline - with buyers reluctant to step in until the impact of world events can be priced in, which is easily a few months away and potentially longer. If you are looking for an exit, then the next couple of days could be critical. It's hard to see indices make it back to multiyear highs without a containment in the Coronavirus outbreak, so today's bounce seems artificial. The Dow Jones Index added 5% as it accelerates toward its 200-day MA on net bearish technicals. Relative performance remains poor (vs the Nasdaq 100) and until there is a relative advantage it's hard to see it sustaining a strong run higher.