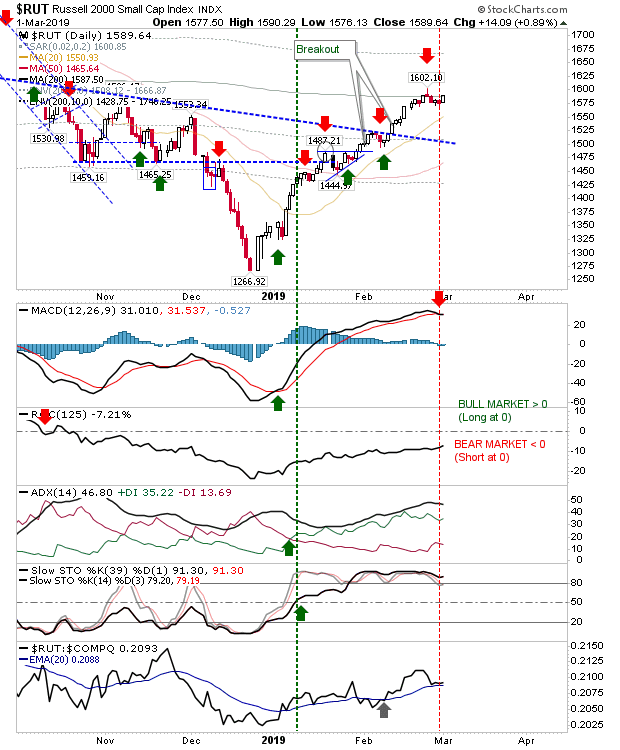

Markets advance in low key gains

There wasn't a whole lot to Friday's action but the main thing was an advance against the tentative weakness which shaped up last week. Best of the action was the Russell 2000 as it gained nearly 1% to bring it back to its 200-day MA Monday could be a critical for the index; look for a push above this moving average to follow the lead of peer indices. The index is also enjoying a relative performance advantage against the Nasdaq and S&P; so if money is going to flow into an index it's going to be the Russell 2000.