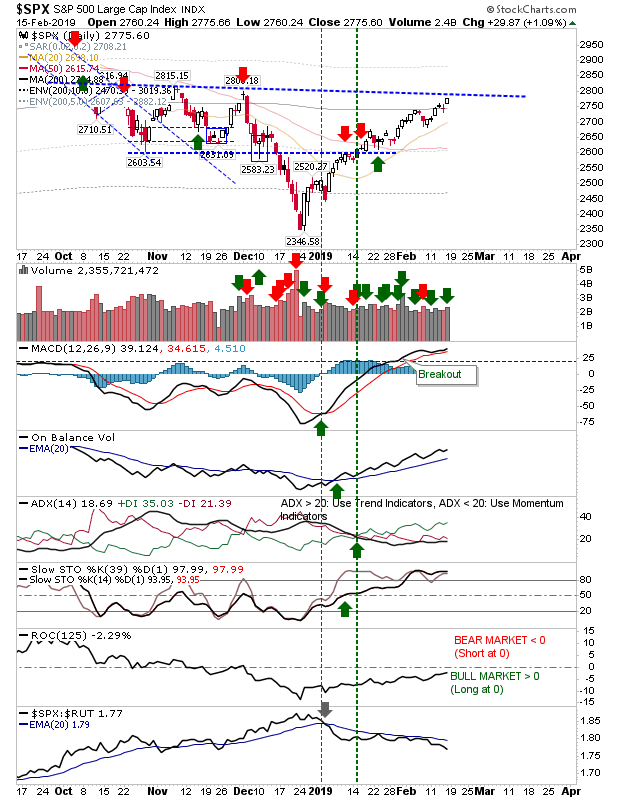

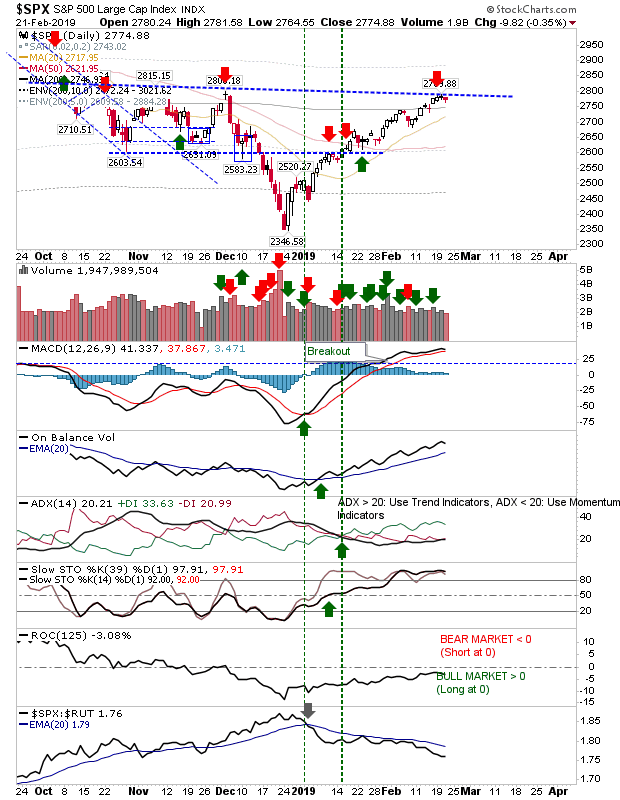

Action Tightens at Resistance

It's all getting very constricted and narrow at resistance but bears haven't been able to break this extended rally. While I have marked nascent potential short positions at such resistance they remain vulnerable to any decent one-day's gain. Ideally, I would like to see indices drift back to their 50-day MAs but nobody seems willing to blink.