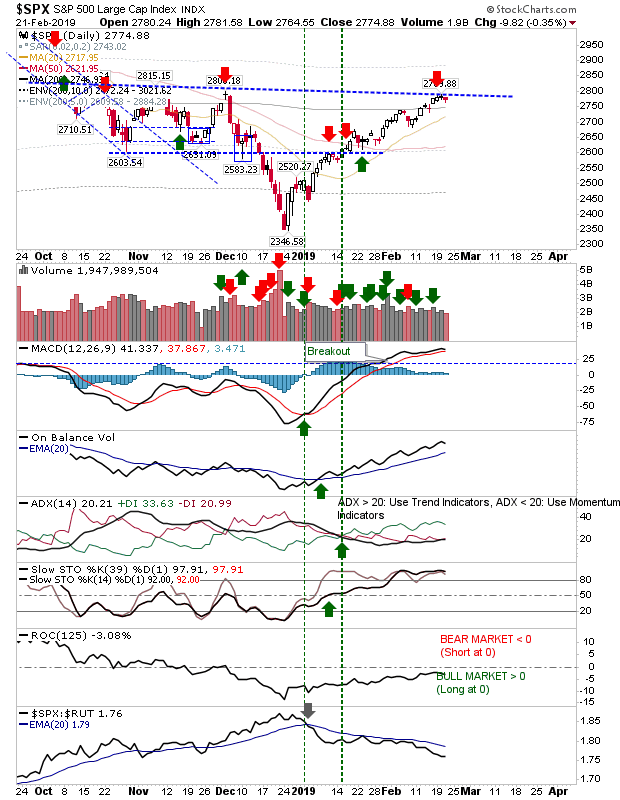

Action Remains Tight

The rally has entered its third month, although the intraday range of the daily bars remains very tight. There was some weakness today, mostly on the Russell 2000, which reversed off its 200-day MA. The Russell 2000 reversal was a fairly picture perfect move off 200-day MA resistance. Shorts may want to take a sniff at this as the MACD prepares to trigger a 'sell'. One point to add is that ROC is firmly on the bearish side of the market and has been relatively immune to the gains in price.