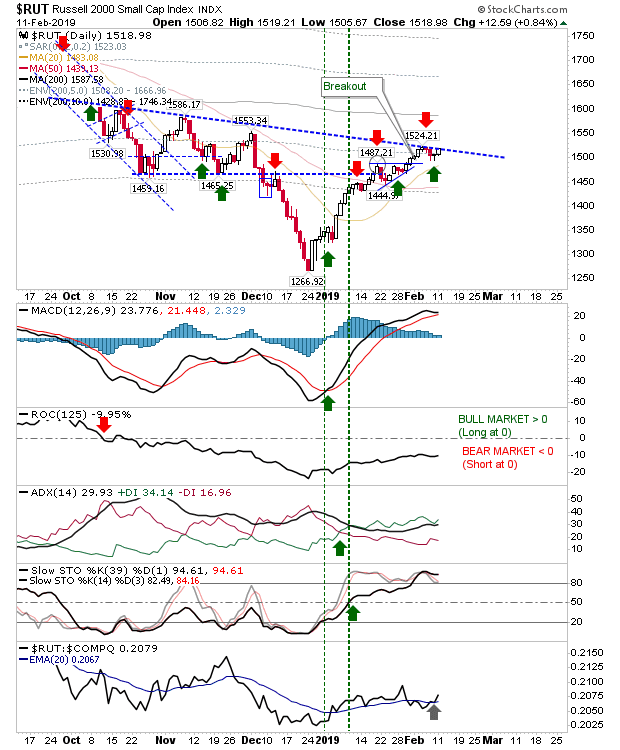

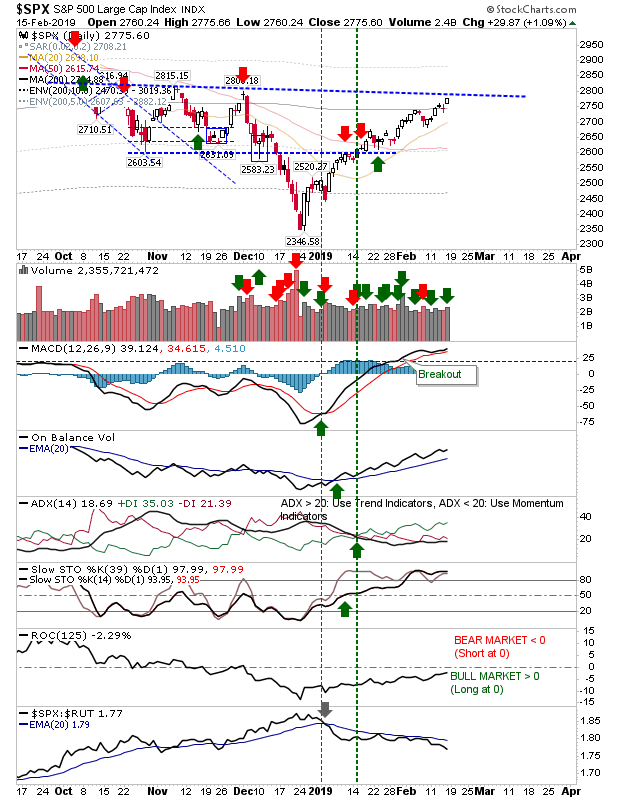

Russell 2000 Approaches 200-day MA; S&P Breaks 200-day MA

It was another day bulls chalked up a victory and indices posted gains across the board. Some indices did better than others but there is no clear weakness to work off yet. The S&P was able to break past its 200-day MA on higher volume accumulation. However, it's coming up against declining resistance. The MACD has already cleared comparable resistance with new highs which would suggest the S&P will be able to do likewise. Other technicals are in good shape and only relative performance (vs the Russell 2000) is underperforming.