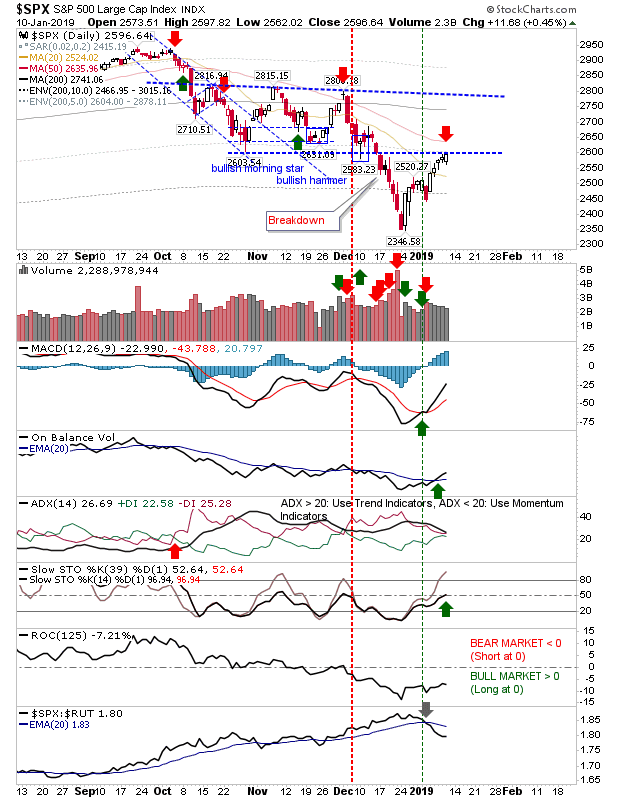

Has the bounce peaked?

Friday offered a day of tight trading on low volume. Swing traders can take advantage of this by trading a break of Friday's range (buy break of high/short loss of low) and setting a stop on the flip side of Thursday's range (of Friday's if you want to take on less risk). This set-up looks the most logical for the S&P. The S&P again kept to resistance defined by the October spike low and now has the 50-day MA offering some additional resistance. Technicals have edged bullish except the Directional indicator which has been slowing since November; an indication of a possible switch to a trading range. Going forward, I would be looking for a shallow decline, perhaps to the 2,500s, before prices stabilize as a sideways range. Again, look to this a swing trade because if Monday starts brightly and can maintain that strength after the opening half hour it will stress existing shorts into covering their positions and open up for a move to the 200-day MA.