Not Great, But Not Bad Either...

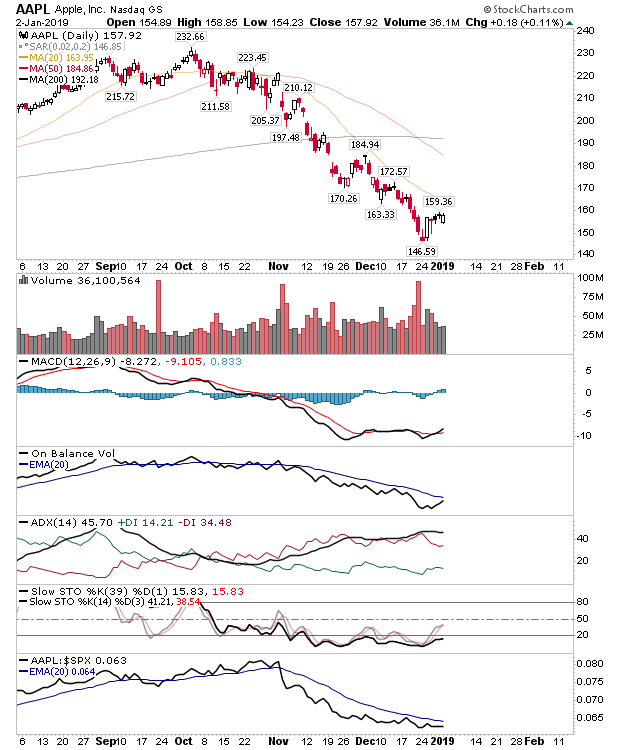

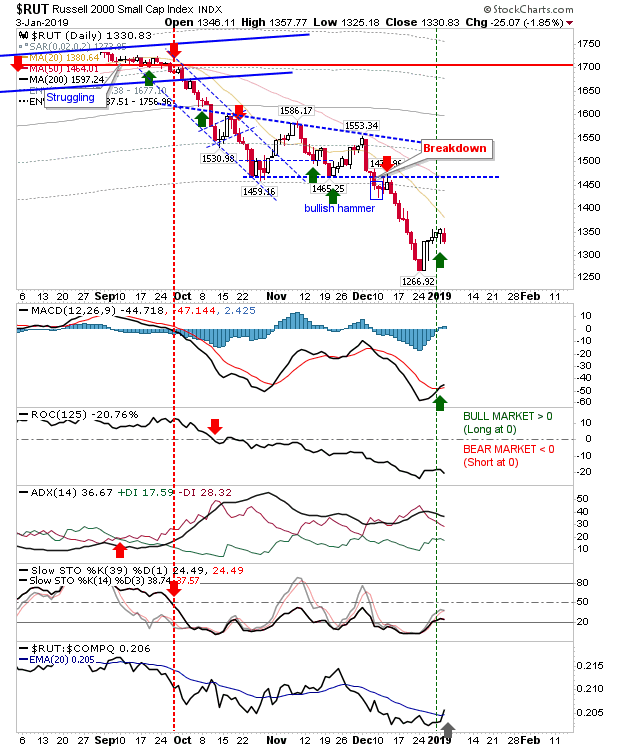

Apple's earnings disappointment had set the market up for turmoil, but again, markets were able to hold up against expected weakness. After December's fall into 'Strong Buy' territory, we now have a market immune to bad news which for investors means they can keep on buying. I had looked to the Russell 2000 to be the next market leader and today's losses weren't enough to reverse a prior relative performance gain against the Nasdaq and S&P. Days like today are typically followed by a loss, which here is ultimately a retest of 1,266. Should this happen, traders can protect themselves with GTC buy orders set around 1,270.