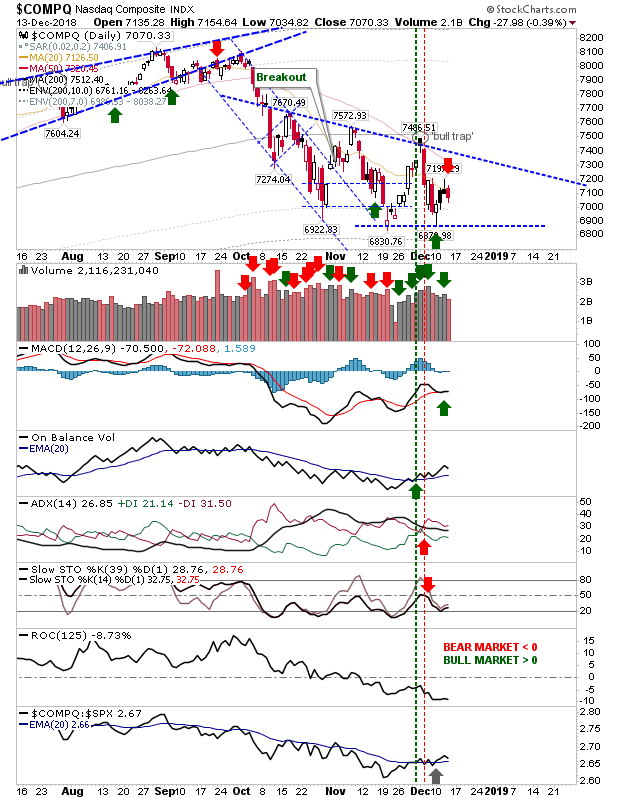

Embrace the Fear - Russell 2000 and S&P in 'Strong Buy' territory

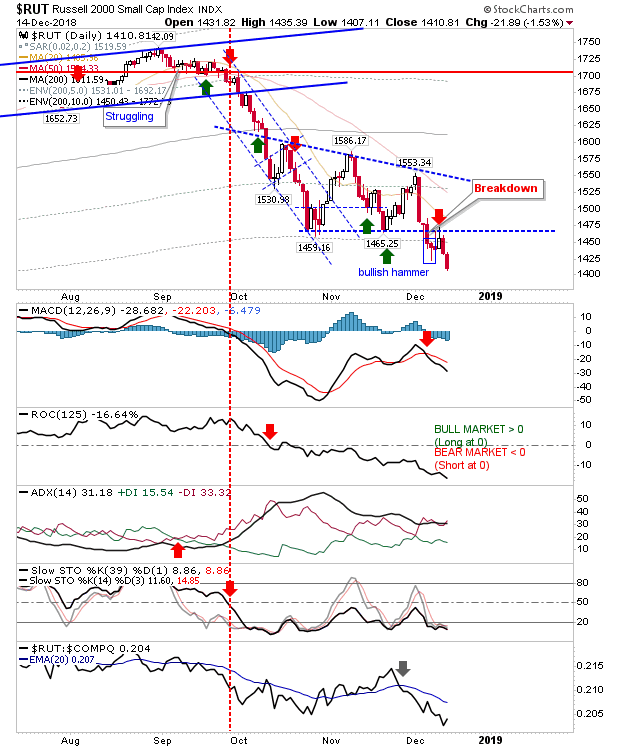

Since my last update markets have taken a bit of a spin. Investors should now take note that both the S&P and Russell 2000 fell into the 'Strong Buy' territory in the move to their respective swing lows. The Russell 2000 fell as far as 20% below its 200-day MA; note, if it reached 21.4% below its 200-day MA it would be in the 1% zone of historic weak action going all the way back to 1987; like it or not, this is a significant investor buying opportunity for Small Caps stocks.