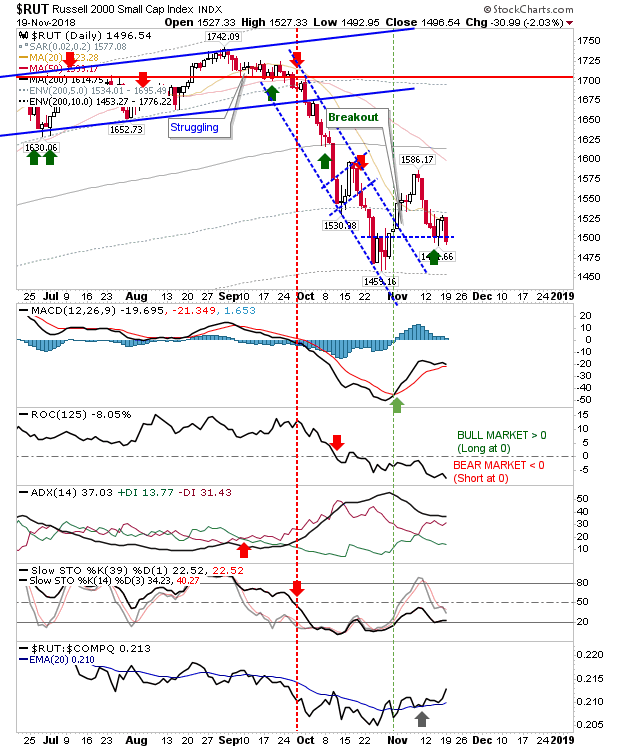

Russell 2000 digs in again - Fresh 'Buy' for Thanksgiving

It could have been better but bulls should be happy with the work done in the Russell 2000. Yesterday's close pushed the index into the 10% zone of historic weak action (reached in October 2018) while also confirming a double bottom on a two-bar reversal. It's a second 'buy' signal after last Thursday's failed.