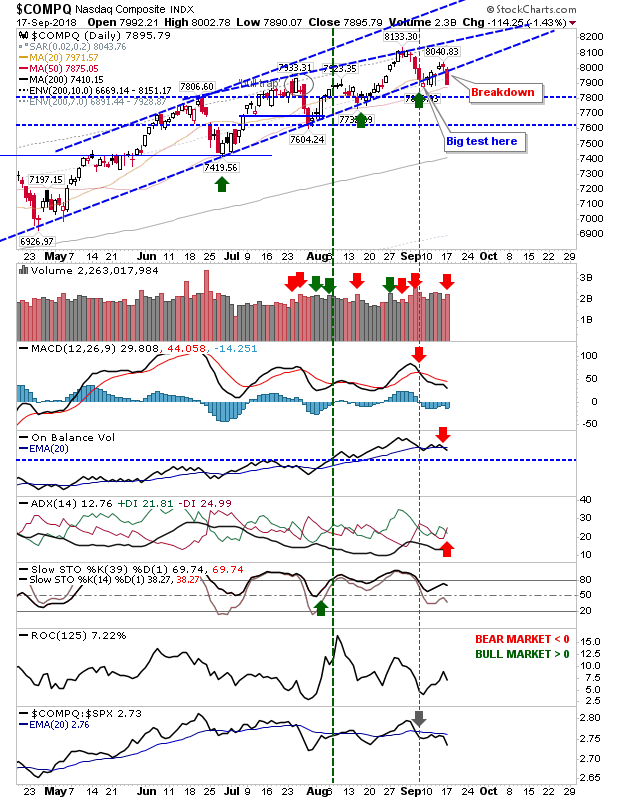

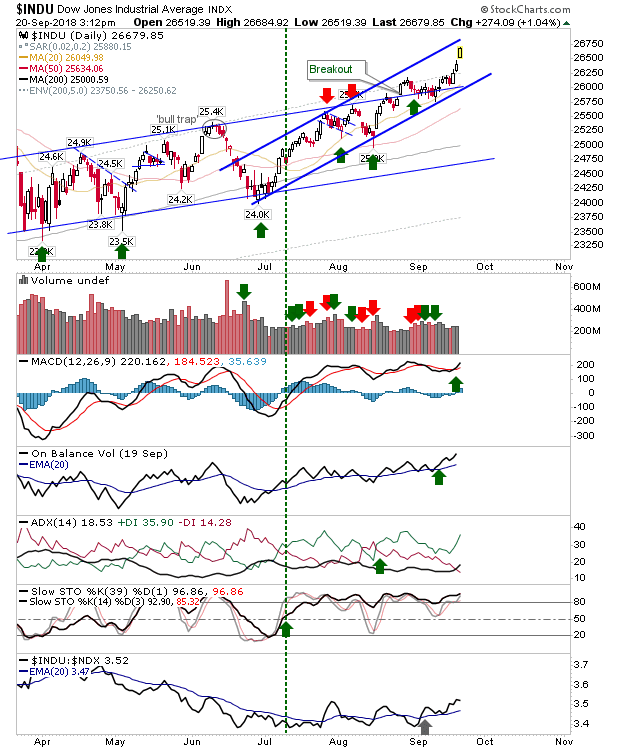

Dow Does All The Leg Work; Indices Recover Breakdowns

Solid gains across the board but it was holders of Dow Jones stocks which had the best of the action, continuing a sequence of gains triggered earlier this week. The Dow Jones Industrial Average will soon be dealing with channel resistance but not until Friday if not early next week. Technials are good. The benefit of this strength was seen elsewhere too