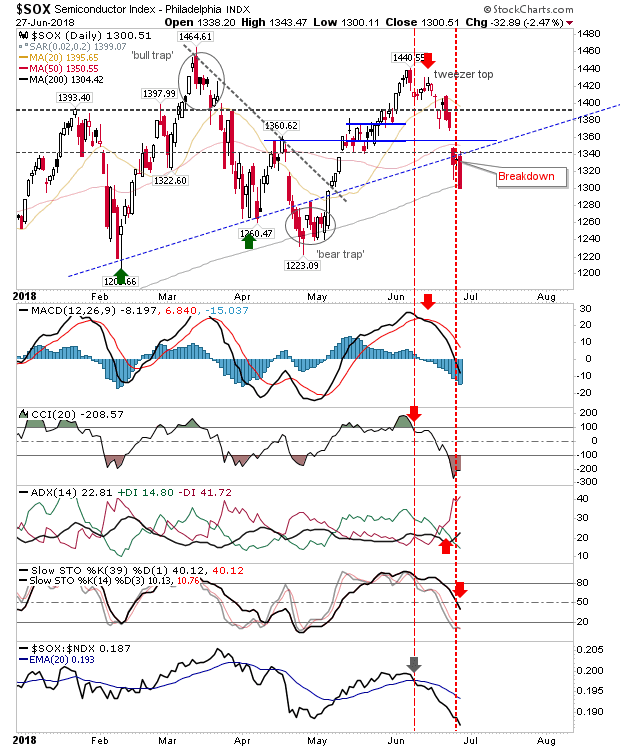

Further Selling Hits Markets

Yesterday's respite didn't lead to a bounce, instead, sellers took another swipe at the markets. The worst performer was the Semiconductor Index as it gave up near 2.5% on the day. Today's selling undercut the trendline and finished on its 200-day MA. Technicals are all net bearish but with intermediate stochastics not oversold there is still an opportunity for further losses. Relative performance also expanded on its losses. The 200-day MA may offer enough traction for a bounce, although given the nature of the sell-off some 'oversell' can be expected.