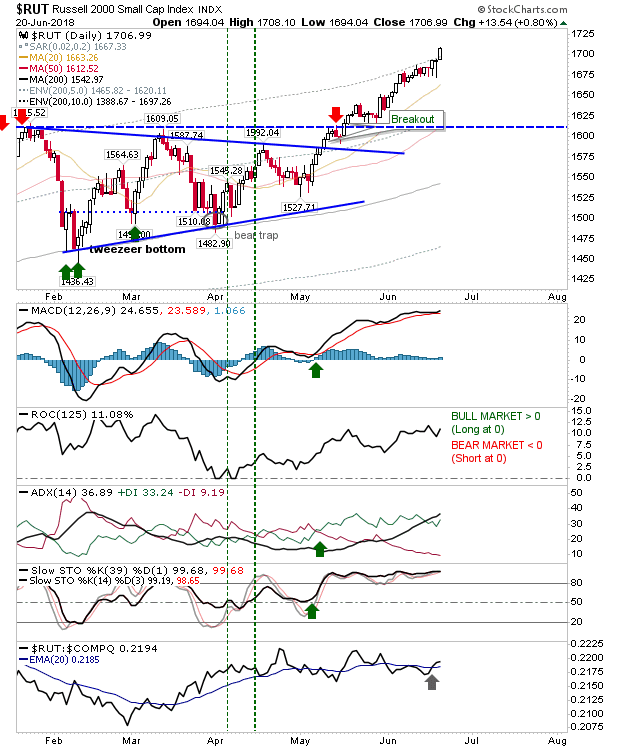

Small Caps Add To Gains

Good news for momentum traders as the Russell 2000 continued its good run. The Russell 200 will start to get hot when it gets into the 15% profit take zone at 1,732 - a zone last seen tested in December 2016; if we are looking at February 2011 levels (the 5% historic zone) then the Russell 2000 would be tagging 1,813. Start taking profits, or sell covered calls, when we get into these levels.

The S&P reversed off resistance in early June and hasn't yet mounted a challenge to break it - today's gain off its 20-day MA ended in a disappointing doji with bearish technicals for MACD, On-Balance-Volume and -DI/+DI feeding into the weak relative performance.

The Dow Jones had been offering shorts a play off the 'bull trap'; it's a scrappy one as prices are back inside the prior channel. The 200-day MA is an area where taking profits would seem prudent (aside from significant bullish reversal candlestick). Technicals, with the exception of Stochastics are all bearish.

The Nasdaq gapped higher but didn't advance beyond the initial opening strength. However, it was enough to register as a new all-time high and all technicals are in good shape. The Russell 2000 is the better momentum play but the Nasdaq has the more attractive risk:reward given its proximity to support.

For tomorrow, eyes will be on market leading Russell 2000. If gains hold it will likely drive money into the more attractive Tech averages breaking to new highs. Large Caps are caught between two ferns and could go either way.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free. I invest in my pension fund as a buy-and-hold.

Dr. Declan Fallon is a blogger who trades for fun on eToro and can be copied for free. I invest in my pension fund as a buy-and-hold.

The S&P reversed off resistance in early June and hasn't yet mounted a challenge to break it - today's gain off its 20-day MA ended in a disappointing doji with bearish technicals for MACD, On-Balance-Volume and -DI/+DI feeding into the weak relative performance.

The Dow Jones had been offering shorts a play off the 'bull trap'; it's a scrappy one as prices are back inside the prior channel. The 200-day MA is an area where taking profits would seem prudent (aside from significant bullish reversal candlestick). Technicals, with the exception of Stochastics are all bearish.

The Nasdaq gapped higher but didn't advance beyond the initial opening strength. However, it was enough to register as a new all-time high and all technicals are in good shape. The Russell 2000 is the better momentum play but the Nasdaq has the more attractive risk:reward given its proximity to support.

For tomorrow, eyes will be on market leading Russell 2000. If gains hold it will likely drive money into the more attractive Tech averages breaking to new highs. Large Caps are caught between two ferns and could go either way.

You've now read my opinion, next read Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to join me on eToro, register through the banner link and search for "fallond".

If you are new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter