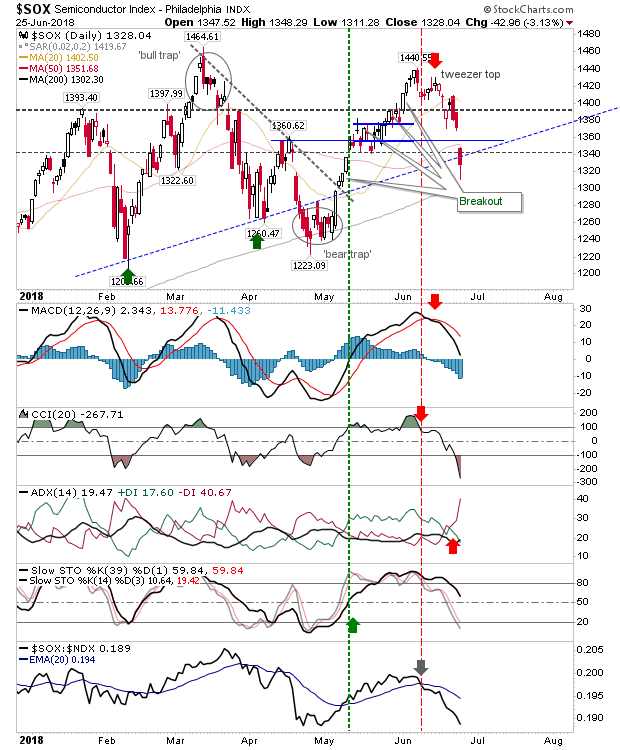

It was worse than expected day for Semiconductors as a sizable gap down and run close to the 200-day MA drove it through many potential support levels. Shorts will be looking to attack the next bounce with a close of today's morning gap the first short entry opportunity (for those who didn't take the 'tweezer top' short).

What this also does is it creates 'bull traps' for both Nasdaq and Nasdaq 100 which are themselves potential shorting opportunities. Those who are looking to short may wish to wait until there is a rally back to resistance marked by the March swing high.

There wasn't much joy for other indices. Losses accelerated for the Russell 2000 as it cut through its 20-day MA. The 50-day MA along with horizontal support is the next port of call; the next bounce will be a chance to take profits if holding long positions.

The S&P drifted deeper inside its consolidation which makes any potential trade more difficult to call. There may be a bounce at the 200-day MA but there is also a chance for an immediate bounce at the 50-day MA given the afternoon recovery to this level.

For tomorrow, early strength will offer an opportunity for buyers to trade an S&P bounce but it could be a scrappy affair. Similar gans which lead to gap closures for the Nasdaq and Nasdaq 100 will then give shorts something to work with. Those looking beyond the next few days can take confidence in this chart provided by

Barry Ritholtz.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on

eToro and can be copied for free.I invest in my pension fund as a buy-and-hold.

. I invest in my pension fund as a buy-and-hold.