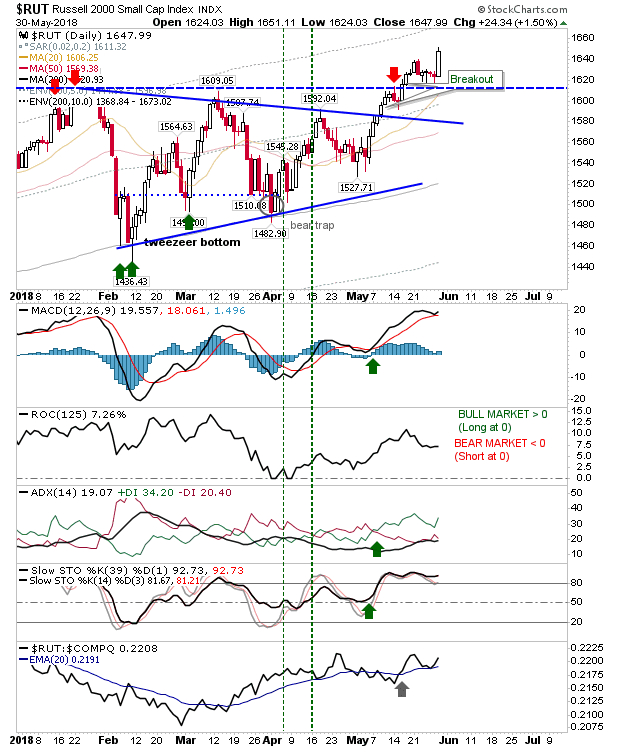

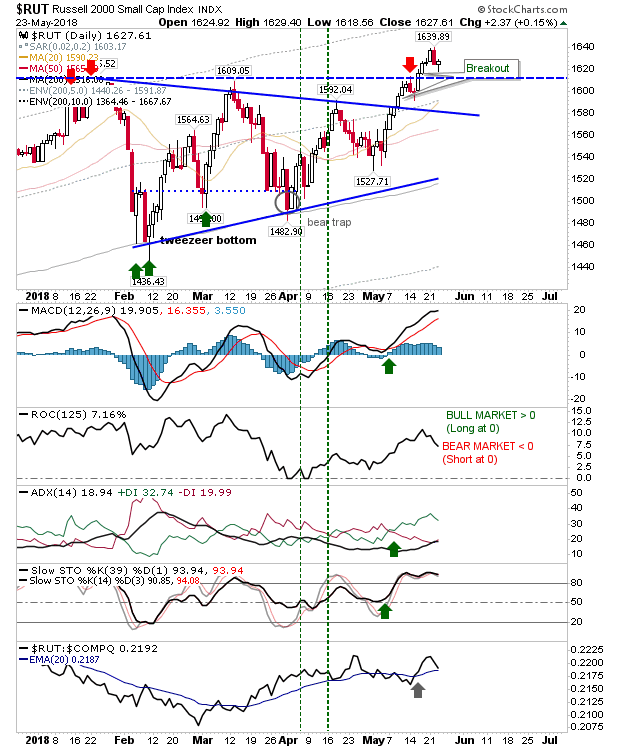

Sellers Challenge Breakouts But Markets Hold On

Trump's tariffs sent markets on a bit of a spin but total selling, while ranked as distribution, didn't go above 1%. More importantly. the bullish setups from yesterday remain valid. Loses in the S&P took the index back to challenging the 'bear trap'. An open around 2,700 could offer a discounted long opportunity.