Bulls Step In - Easing Bearish Concerns as Small Caps Breakout

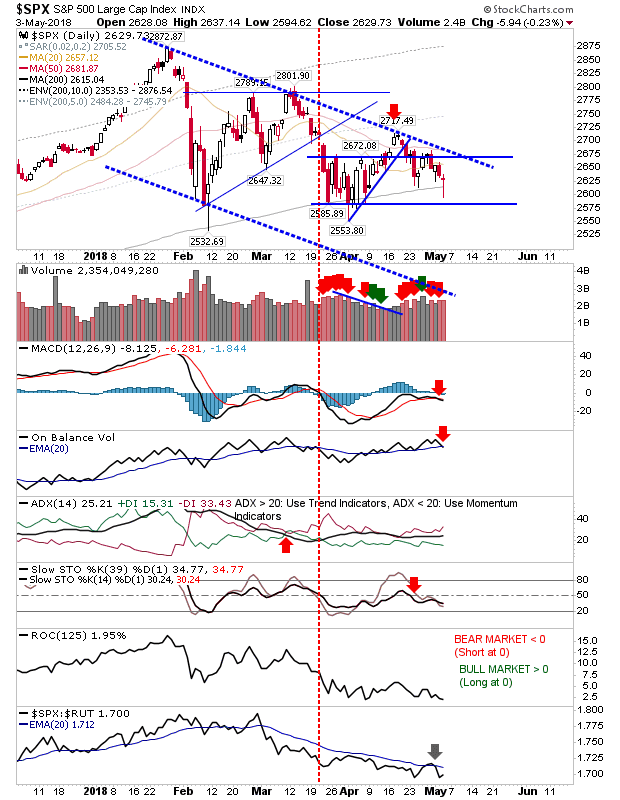

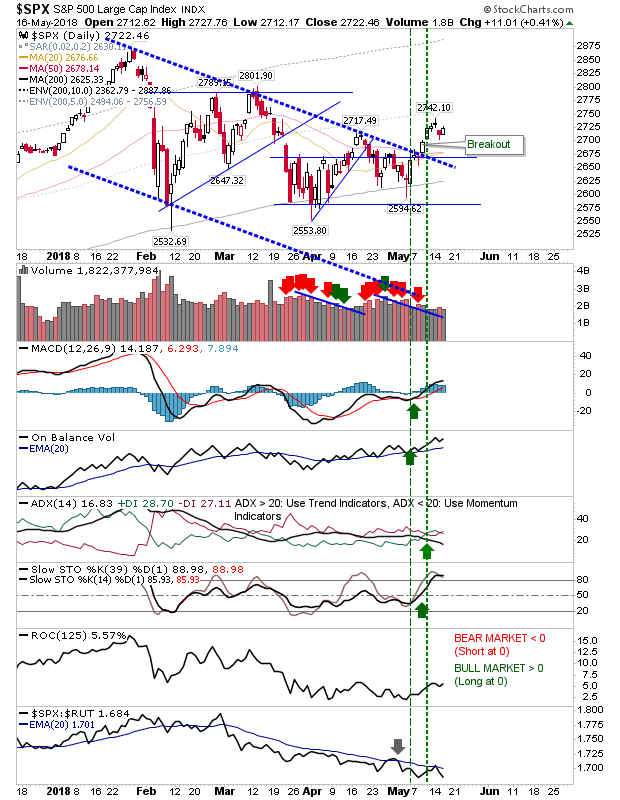

Monday offered the bearish doji / swing high set up which had looked like it was going to create the 3-day bearish evening star set up across markets; this pattern did present itself Tuesday with the gap downs but today (Wednesday) saw rallies which were enough to close these gaps but not enough to negate the 'bearish evening star' setups. However, the bearish 'evening star' is typically a reliable setup and the lack of follow through lower suggests more upside is to come The S&P had its breakout last week with supporting technicals all bullish, with the exception of relative performance. Despite this, look for a continuation of this rally.