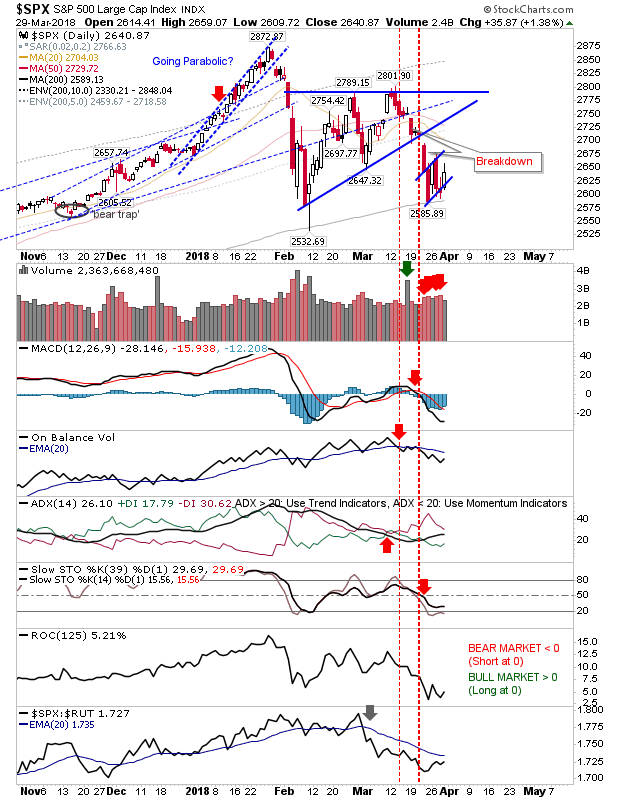

Bulls Try To Stabilize Market

Tuesday's sell-off did much to rattle the confidence of bulls; Thursday's attempt to bid markets back to Tuesday's highs lacked confidence as demonstrated by the relative gain and the lighter volume. Friday is an opportunity to give markets a little boost heading into the Easter weekend. Futures suggest a positive open so it will be a question as to whether markets can build on it. The S&P is still shaping a 'bear flag' on the bounce off the 200-day MA. While technicals are net bearish they are not oversold.