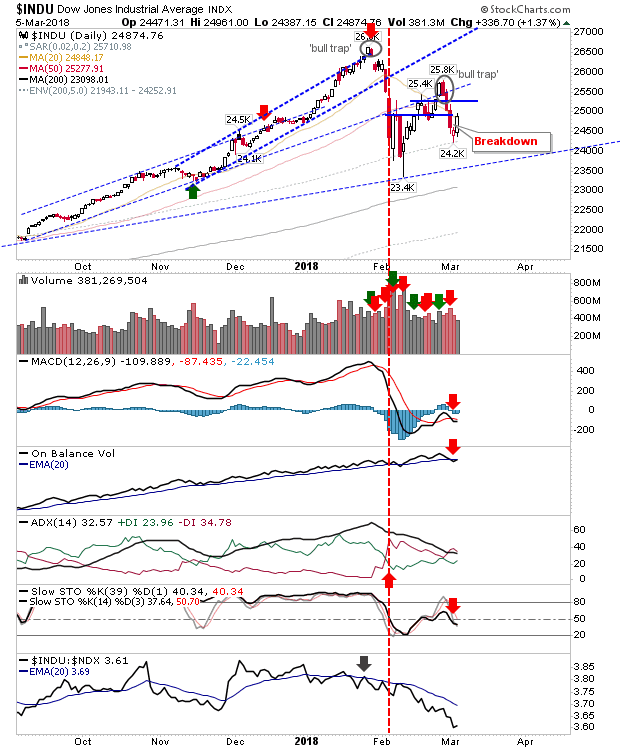

Nasdaq Threatening 'Bull Trap'

A second day of selling brought the indices back towards support. The index looking most vulnerable with the potential to 'bull trap' is the Nasdaq. I'm not sure enough damage has been done to confirm this but another day's selling would probably be enough.