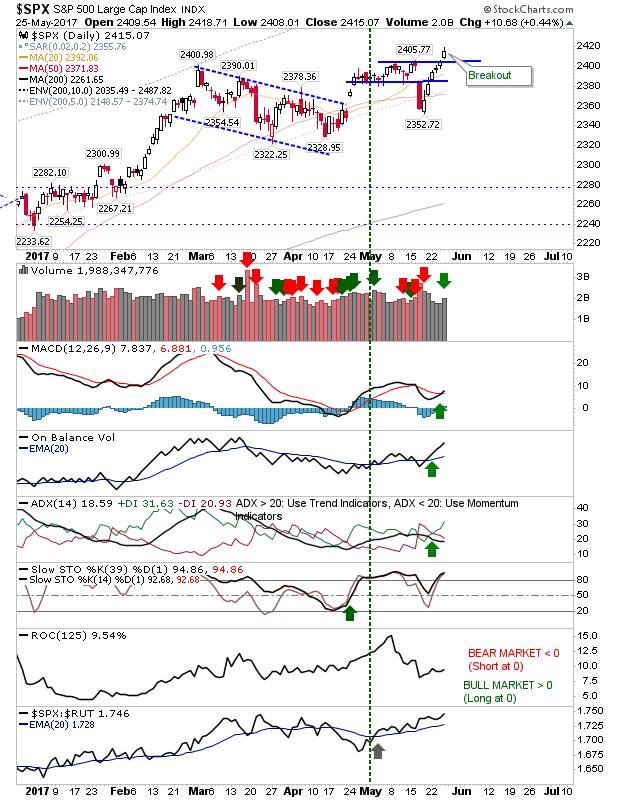

Volume Selling Pickup But Breakouts Hold

After a couple of weeks of light trading volume picked up as seller returned to markets. However, sellers were unable to reverse market breakouts. The S&P tagged 2,403 at the low of today, but recovered to leave it halfway between recent highs and 2,400. Technicals are net bullish with the MACD slowly building on its recent 'buy' trigger.