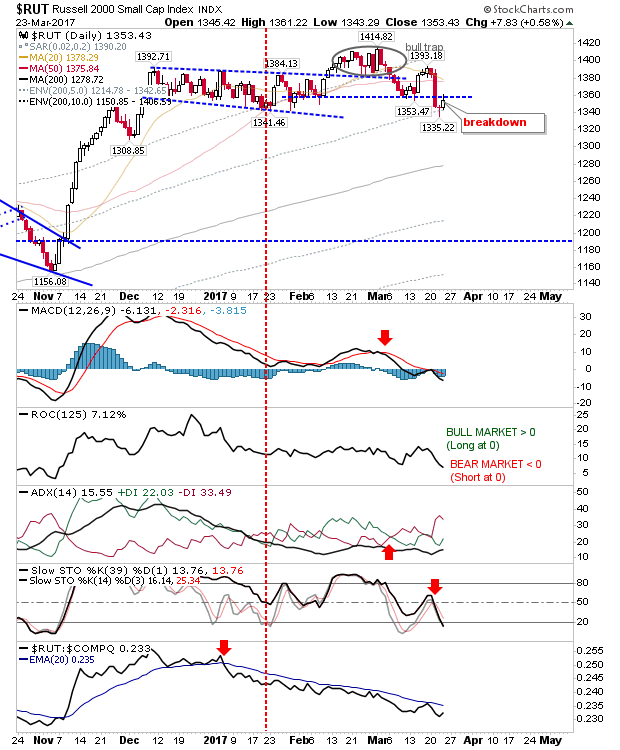

Small Caps Advance

There were small gains across markets, but it was the Russell 2000 which benefited the most. Today's gain managed to push past the 20-day and 50-day MAs on a fresh MACD trigger 'buy'. Next up is a 'buy' trigger in the relative relationship between Russell 2000 and Nasdaq.