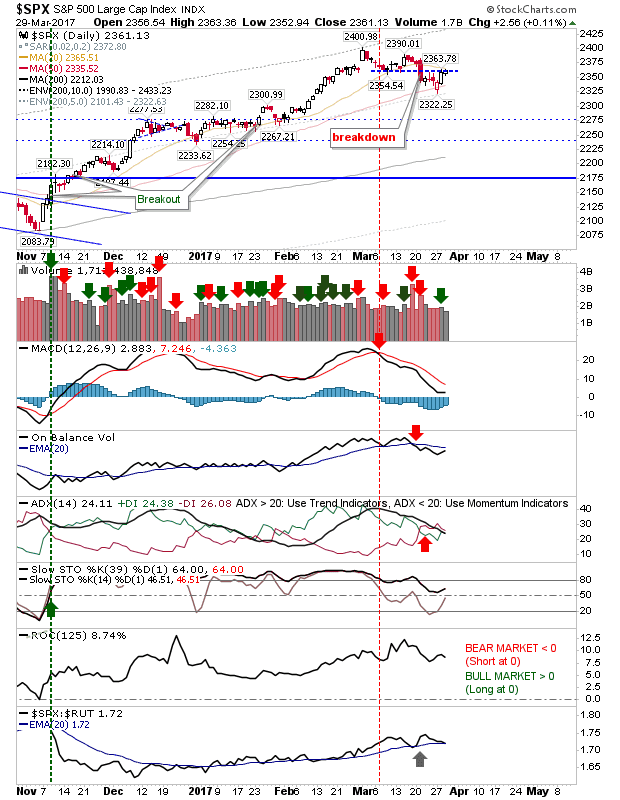

The Swing Low continues to play out with small gains in lead markets. There is still resistance in play, but this supply is been consumed by the day. Trading volume was light too.

The S&P is at resistance from the March swing low, but today's gain did little to get past this. Stochastics are bullish, but other technicals are negative and the last two days of didn't change this. While bears may think there is an angle to work, the most likely outcome is for a gain which returns a challenge of 2,400.

Unlike the S&P, the Nasdaq has managed to get past this March-level resistance and only has 5,928 to break before confirming new all-time highs. The MACD has been pushing a 'sell' trigger since March, but Stochastics and On-Balance-Volume have been very strong since the election. The rally just above the 50-day MA has helped too. Buyers look ready for more which would deliver a fresh 'buy' trigger above the bullish zero line.

The Russell 2000 also got past March swing low resistance, but it hasn't the technical strength like the Nasdaq. The presence of converged 20-day and 50-day MAs adds to the trouble as resistance. If there was an undercut of the March swing low (for a second time) it would convert the 'bear trap' from last week into a 'bull trap' and open up for a move back to the 200-day MA. Shorts best opportunity looks to be here.

The other index to watch the Semiconductor Index. It has fallen outside of the rising channel generated by the election, but a new upward channel may be taking shape. Confirmation is needed, with a move to tag the thin hashed blue line, but if this doesn't hold, then the rising blue line from the November swing low is an alternative.

For tomorrow, the S&P is best set up for bulls, but shorts can take a look at the Russell 2000

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is a blogger who trades for fun on

eToro and can be copied for free.

. I invest in my pension fund as a buy-and-hold.