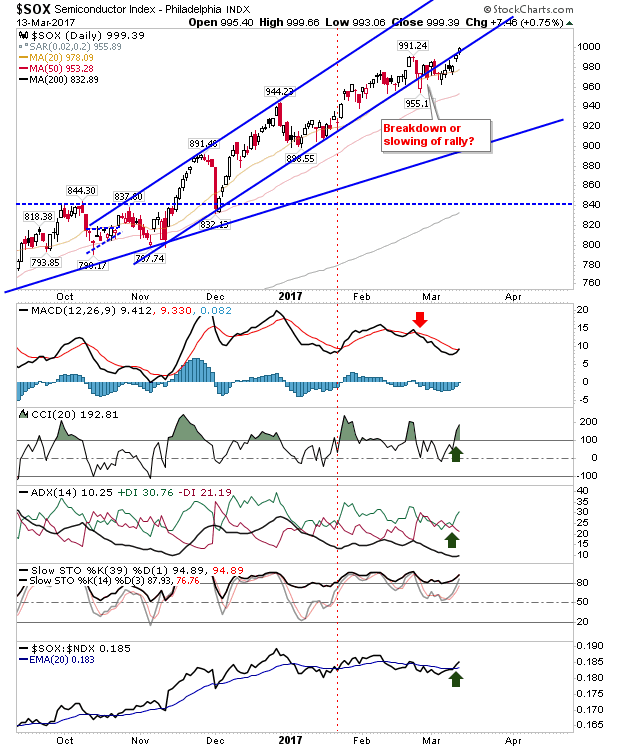

Tentative Gains

Not a whole lot to say about today. The Semiconductor Index gained nearly 1% as it pushed a new multi-year high, but most of the gains were achieved by the open and it didn't add too much after that. However, it did keep shorts at bay for another day (resistance remains former channel support).