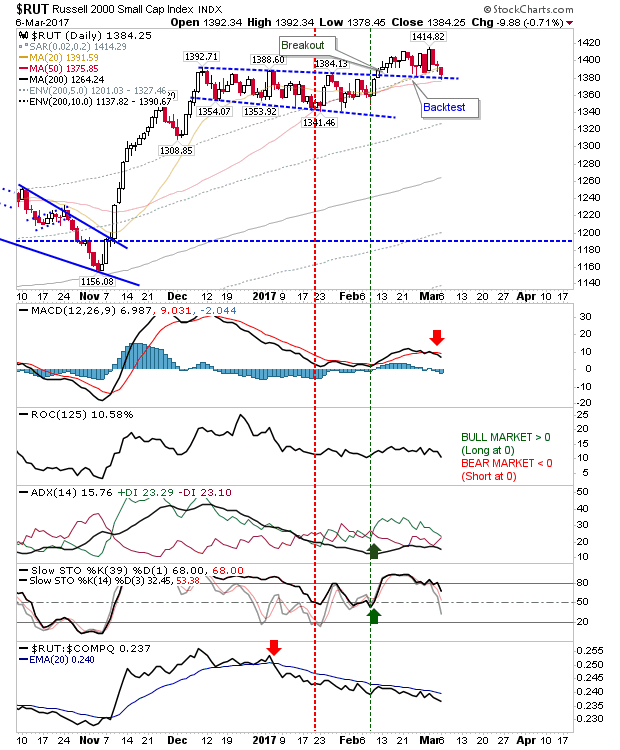

Small Caps Slow Morph a Bull Trap

It was another quiet day for most indices, but the Russell 2000 dropped into a potential 'bull trap' situation. The Russell 2000 experienced further weakness with a 'sell' trigger in the +DI/-DI with Slow Stochastics [39,1] just above the bullish midline - now the last line defense of the net bullish picture for this index.