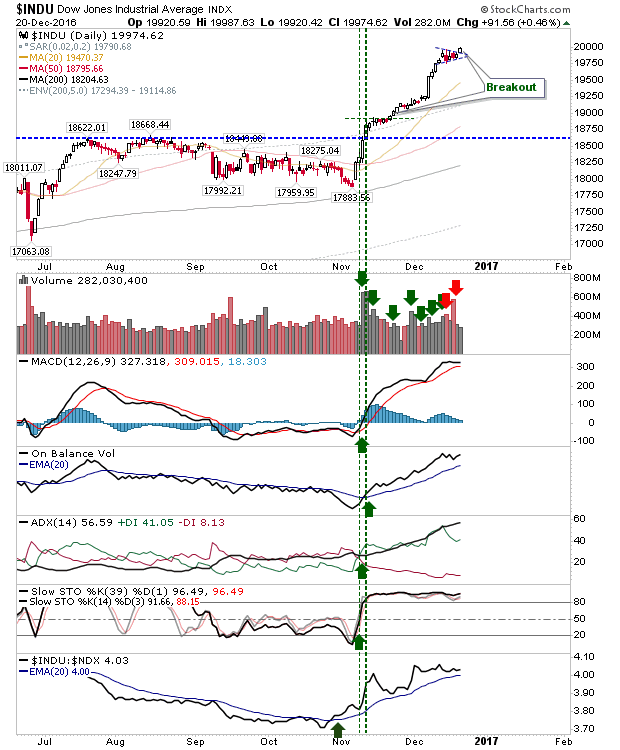

Bull Trap for Nasdaq?

The initial upside breaks from the coils are faltering a little. The index showing the most vulnerability is the Nasdaq. There was some recovery before the close of business, but the damage has already been done. Technicals are still holding on the bullish side, with the exception of relative performance (against the S&P). Volume climbed to register distribution, but in holiday volume terms.