Fed Influences Dip Buying

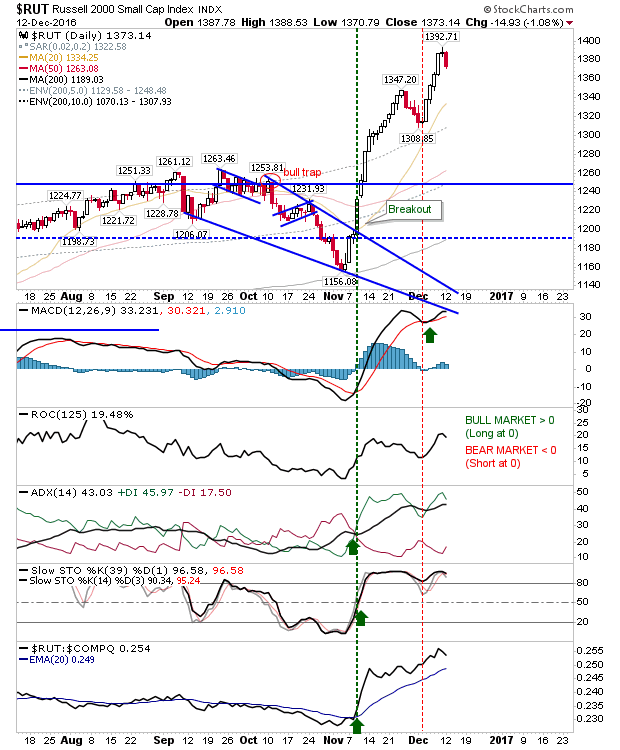

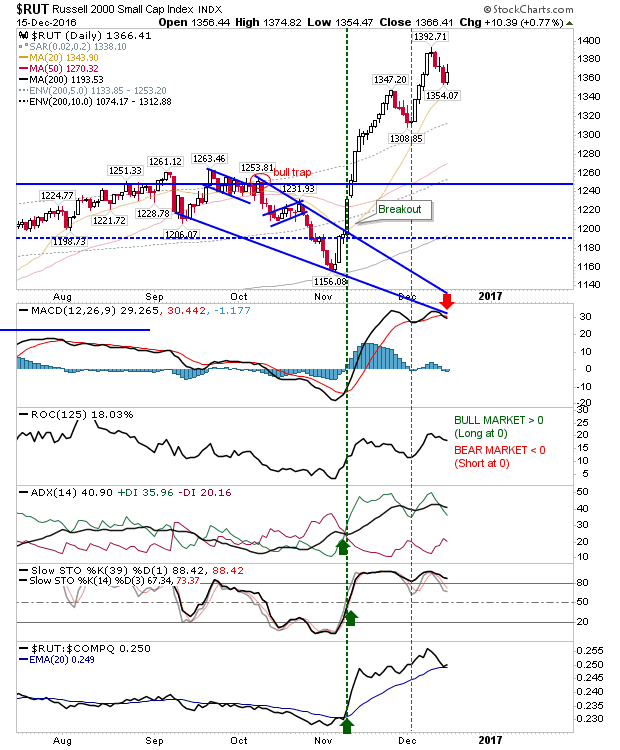

The Fed's announcement for faster rate hikes killed off my EURUSD trade and threw markets into a state of confusion. Traders had looked to regain their edge today, but late selling was enough to take some of the wind out of their sails. Having said that, it looked easier for profit takers to follow through on yesterday's Fed action than to scramble back in as buyers. The Russell 2000 had the best of the action, managing to retain the most of today' gains. There was a 'sell' trigger in the MACD, but given its relative position to the bullish zero line this looks to be a typical pullback action (which may not be done yet).