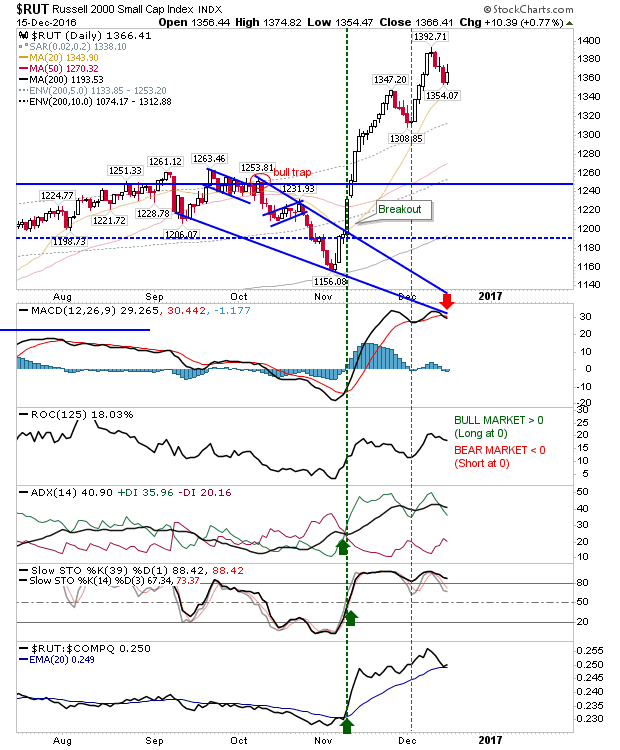

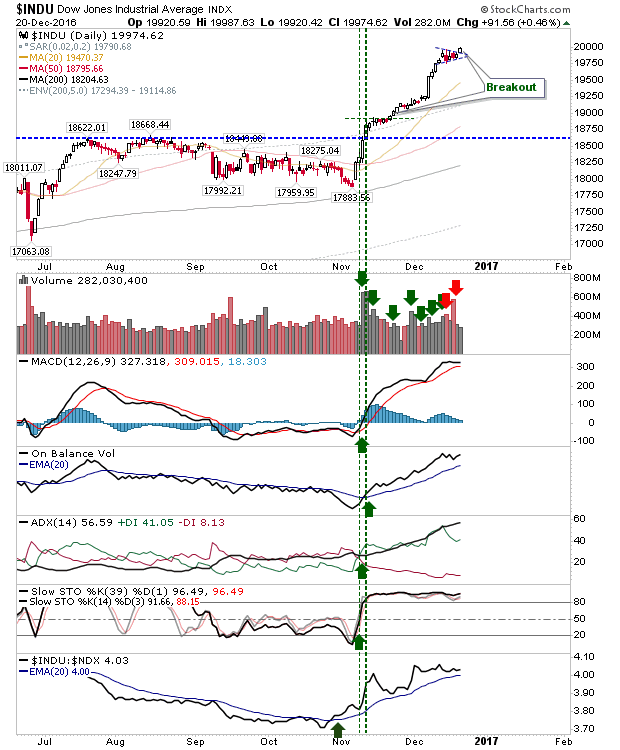

Bulls Lead Out of Coil

Action into today had looked to offer bears the advantage, but it was a morning gap higher from buyers which gave bulls the initiative. Beyond the opening gap there wasn't too much more buyers were able to achieve, with the exception of the Russell 2000, but today's gains would be enough to put bears/shorts on the defensive. The lack of upside follow through may offer more aggressive shorts an opportunity. The Dow made a clean upside break of the consolidation.