The Fed's announcement for faster rate

hikes killed off my EURUSD trade and threw markets into a state of confusion. Traders had looked to regain their edge today, but late selling was enough to take some of the wind out of their sails. Having said that, it looked easier for profit takers to follow through on yesterday's Fed action than to scramble back in as buyers.

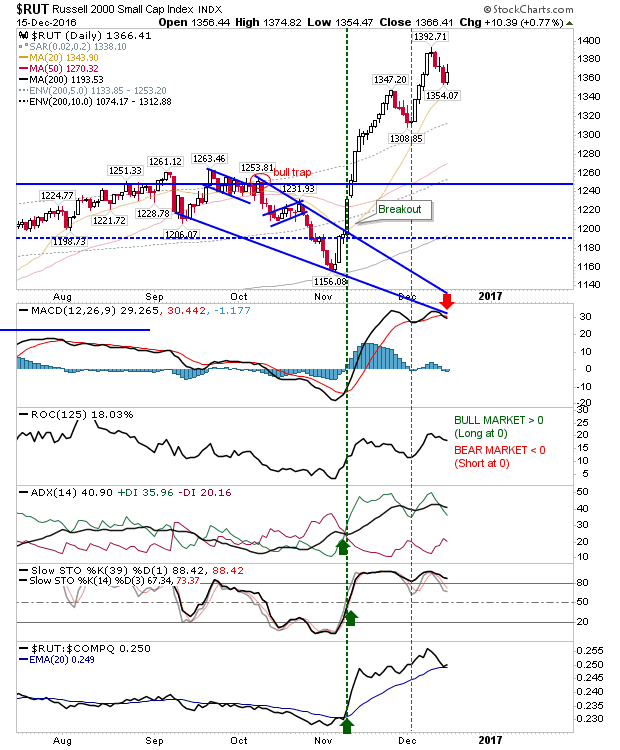

The Russell 2000 had the best of the action, managing to retain the most of today' gains. There was a 'sell' trigger in the MACD, but given its relative position to the bullish zero line this looks to be a typical pullback action (which may not be done yet).

The S&P experienced significant volume distribution yesterday, but the run of gains over recent weeks have seen the index make significant relative gains against its peers. Unlike Small Caps, the S&P hasn't yet tagged the historic overbought zone.

The Nasdaq is another index trying to make up lost relative ground. It has struggled since mid-October, but the December push helped clear Autumn/Fall consolidations and given it room to drive a Santa rally. Aside from relative performance, other technicals are healthy

To watch for tomorrow are morning gaps higher which fail to advance over the course of the trading day. Should markets finish with 'doji' or some other neutral candlestick it will leave traders pondering their positions over the weekend and whether defensive selling is better than offensive holding/buying.

You've now read my opinion, next read

Douglas' blog.

I trade a small account on eToro, and invest using Ameritrade. If you would like to

join me on eToro, register through the banner link and search for "fallond".

If you are

new to spread betting, here is a guide on position size based on eToro's system.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are

converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician for

ChartDNA.com, and Product Development Manager for

FirstDerivatives.com. I also trade on

eToro and can be copied for free.