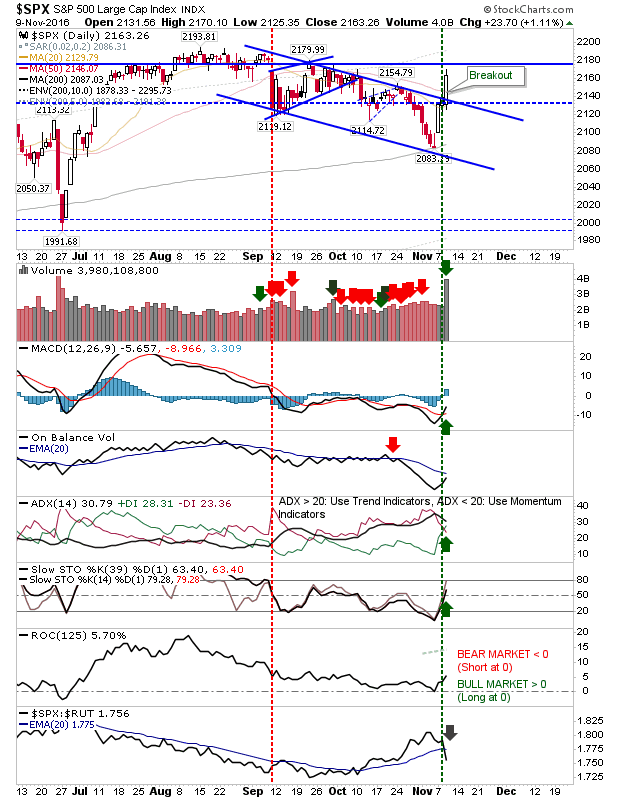

S&P and Semiconductors Breakout

Market divergences continued to play out. This time, the S&P and Semiconductors broke clear in fresh breakouts, but the likes of the Nasdaq and Nasdaq 100 haven't yet followed Semiconductors higher. The S&P cleared the last swing high, but still has August highs to breach. Technicals, outside of On-Balance-Volume, are bullish. The Nasdaq finished higher but hasn't yet marked new all-time highs. As with the S&P, technicals - other than On-Balance-Volume - are bullish.