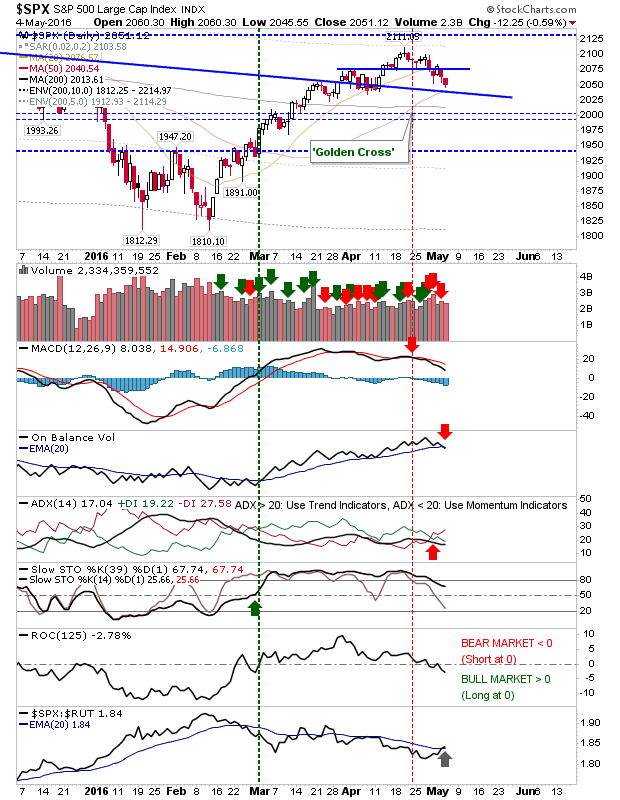

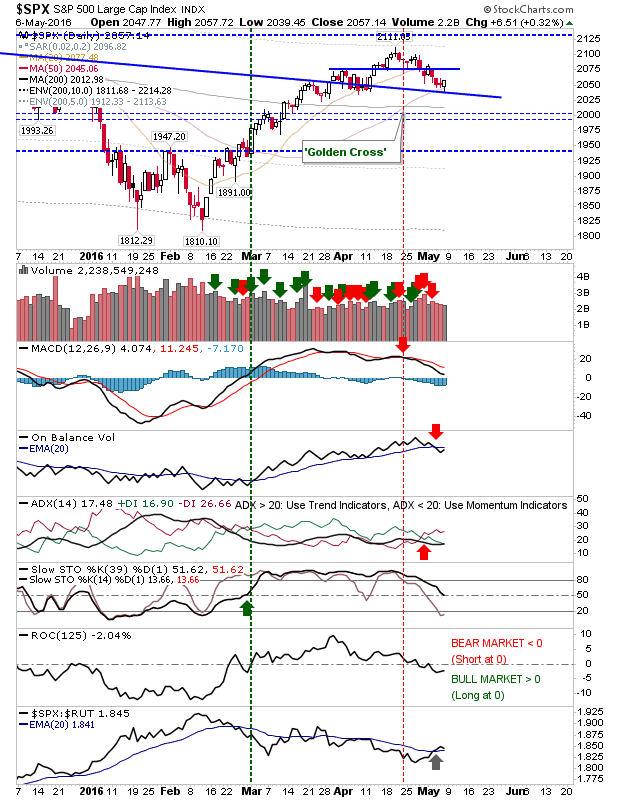

Positive Friday on Light Volume

Friday delivered a positive end-of-week close after a sequence of down days. Volume was not impressive and was below mid-week selling. The S&P dug in at its 50-day MA, but is holding to 'sell' triggers in the MACD, On-Balance-Volume, and -DI/+DI. Relative performance finished the week with Large Cap strength overall Small Caps. Rate-of-Chart moved back to the bullish mid-line in what could offer itself as bullish buyback opportunity.