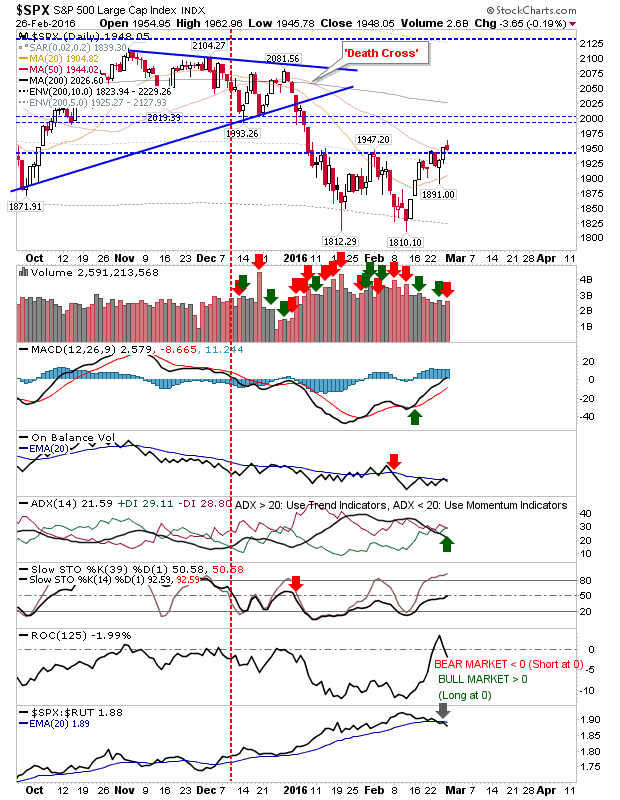

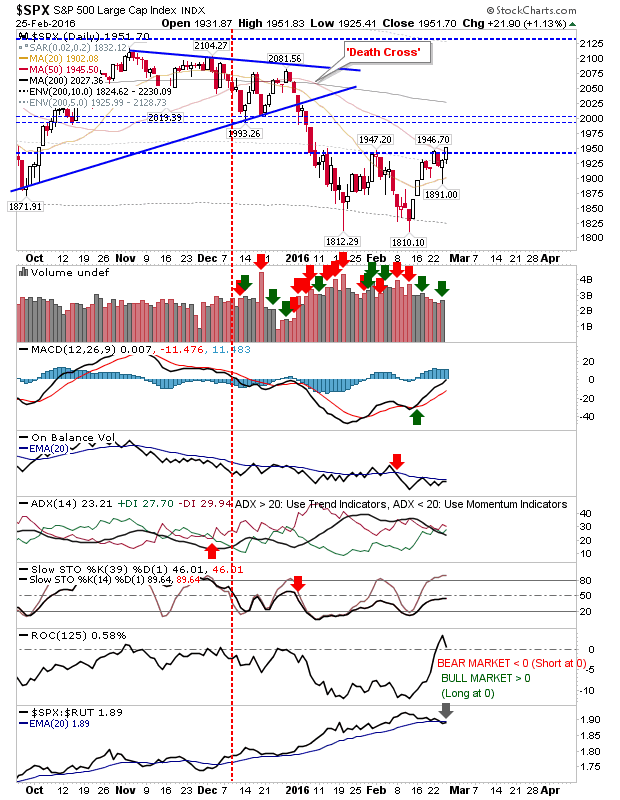

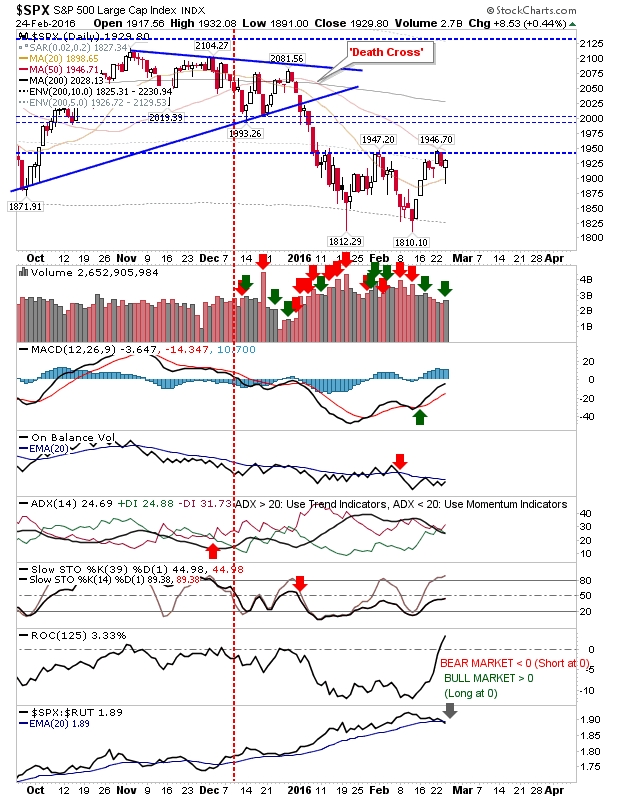

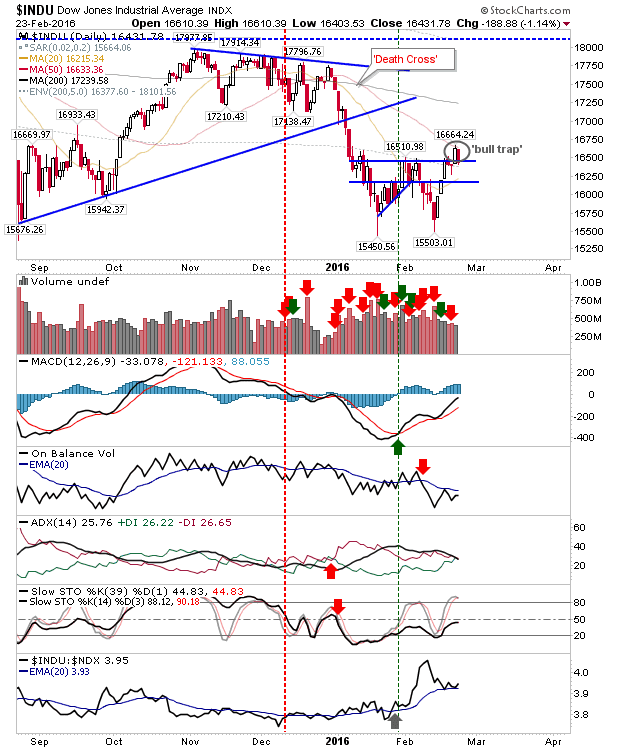

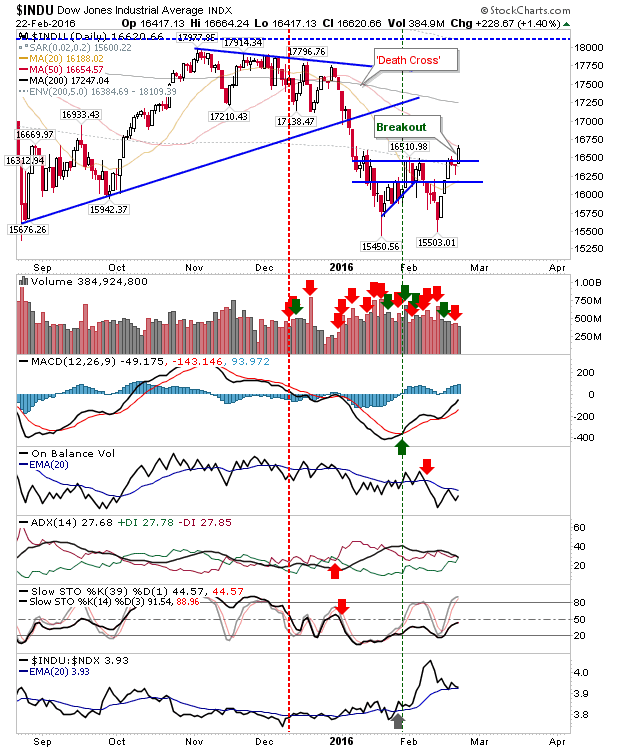

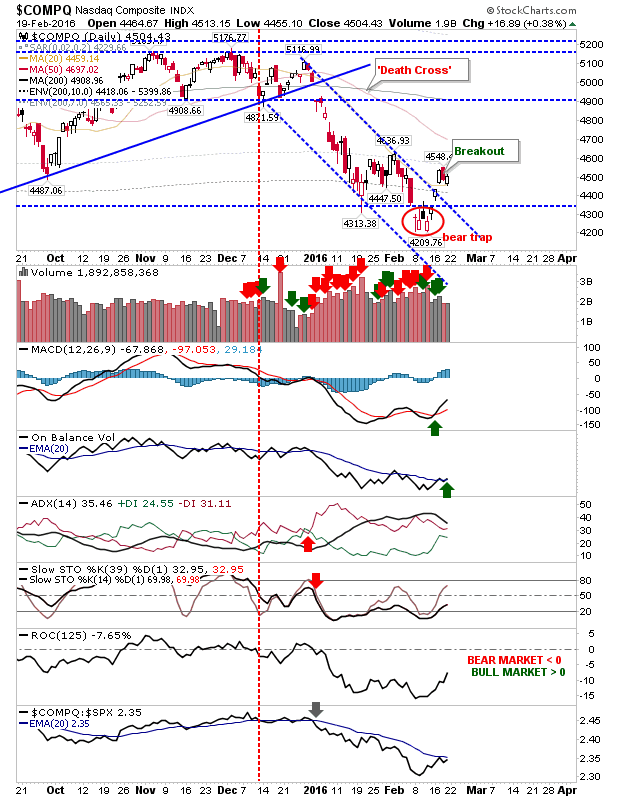

Sellers Deliver Second Day Of Losses

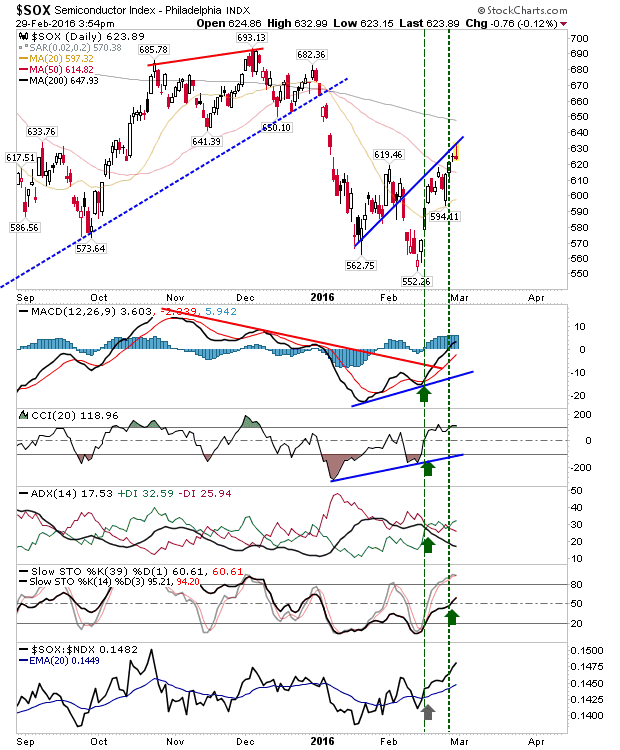

A little more damaging than Friday in that early gains couldn't stick in what would have been a respectable rebuttal of those losses. The Semiconductors managed a perfect tag of resistance before it headed south. Shorts will have had the best of the opportunities today, although technicals are still net bullish.