Stall in Advance, but Bulls can be Happy

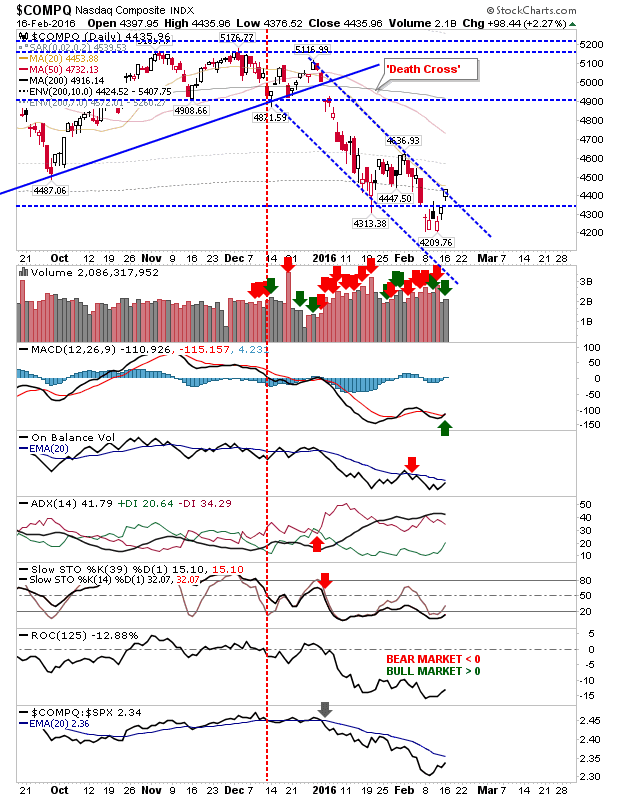

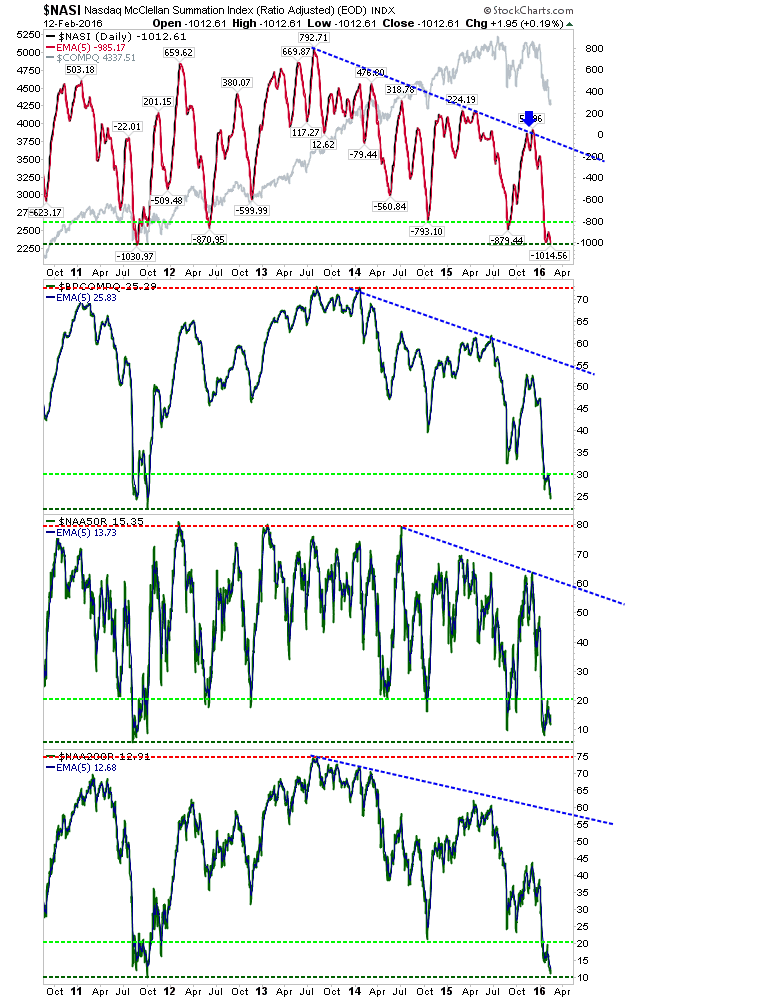

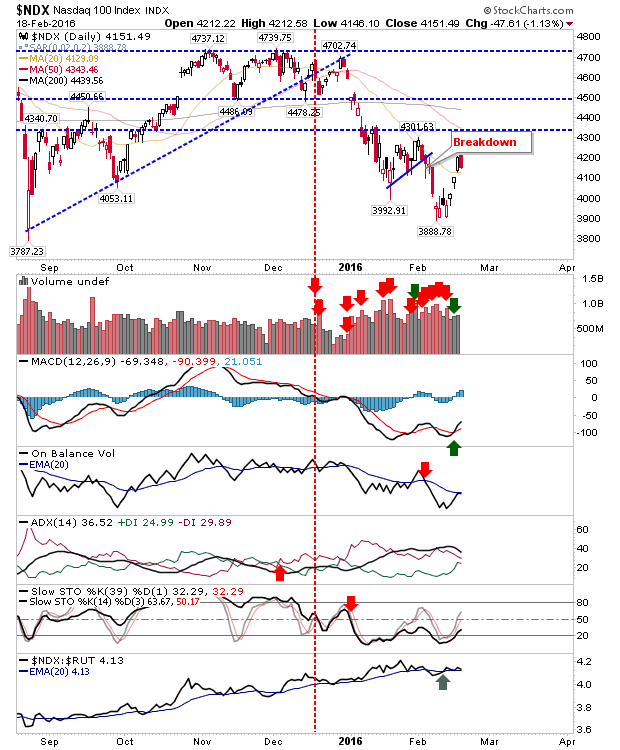

It was inevitable, given the action over 2016, that bears were going to make an reappearance. Today's selling fell in line with near term profit taking with volume down on recent buying. The Nasdaq 100 experienced the worst of the selling, but buyers will be looking at a move down to 4,000 to buy value. More higher volume accumulation days would help build confidence. The Russell 2000 has done well to rebuff the heavier selling which has marked this index over the last part of 2015. Action over the last couple of weeks has the look of a 'bear trap', and today's narrow action should be favourable for bulls. If there is a push into the 'bear trap' it will be important for buyers to accelerate by creating a spike low. The S&P is sitting just below 1,940 and is on the verge of confirming a double bottom. The 50-day MA is fast approaching from above in a convergence with 1,940. A break of this combined resistance zone would firm up an intermediate ter