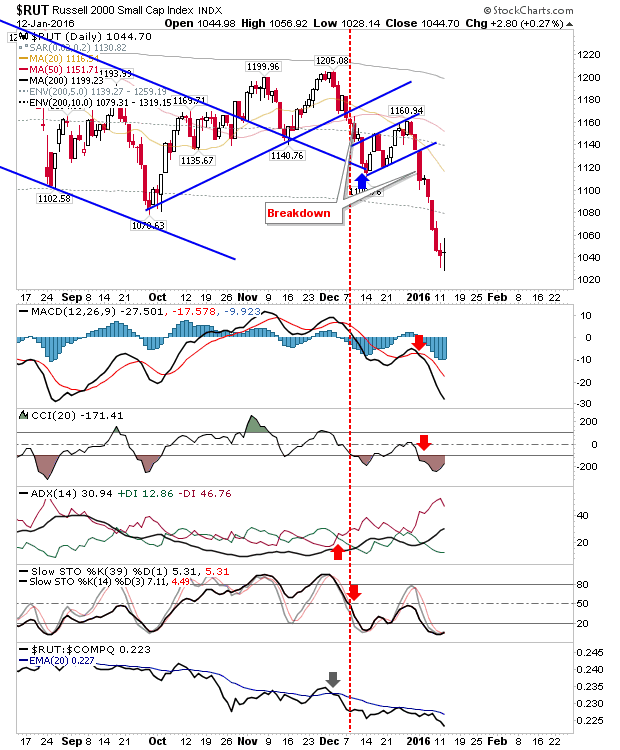

Small Caps Continue To Feel Pain

It was an odd day. Early gains were quickly erased, but some markets managed to regain some lost ground by the close. The Russell 2000 experienced the worst of the action and is finding it hard to attract buyers. The next milestone is the 25% discount from highs at 972, then the measured move lower at 951.