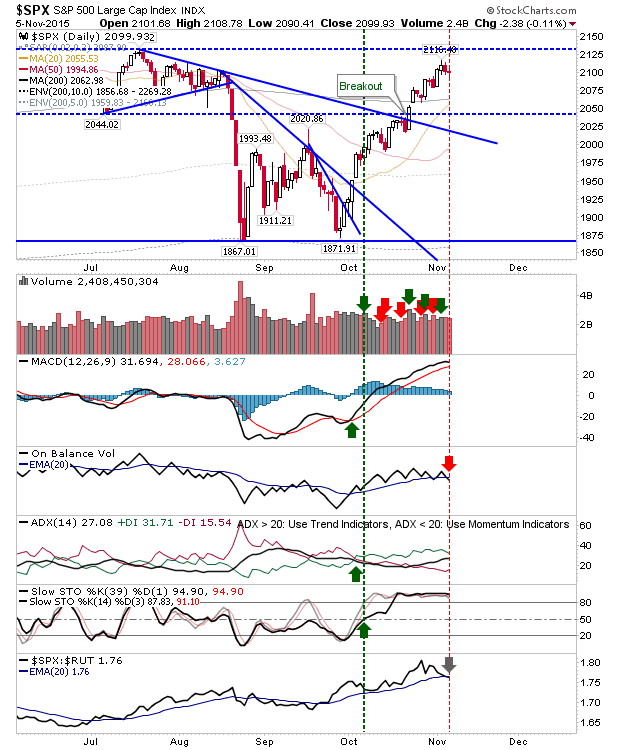

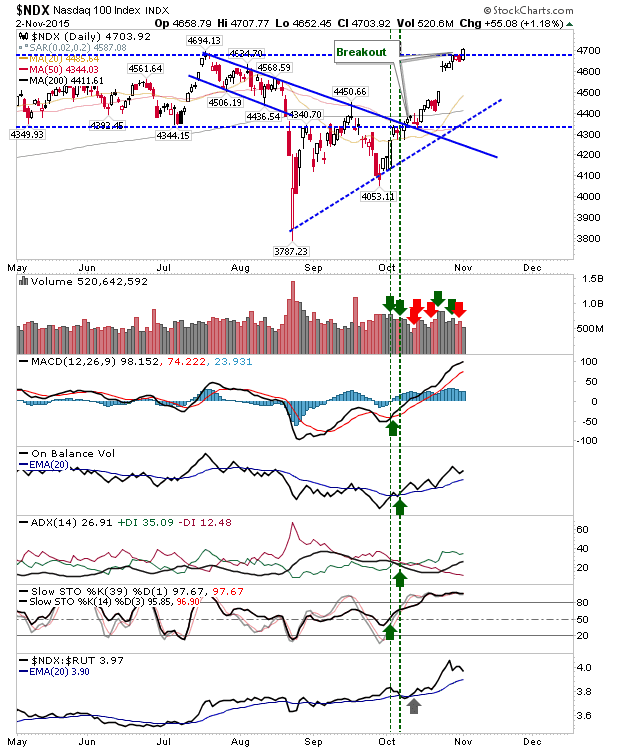

Bulls Keep Things Ticking Over

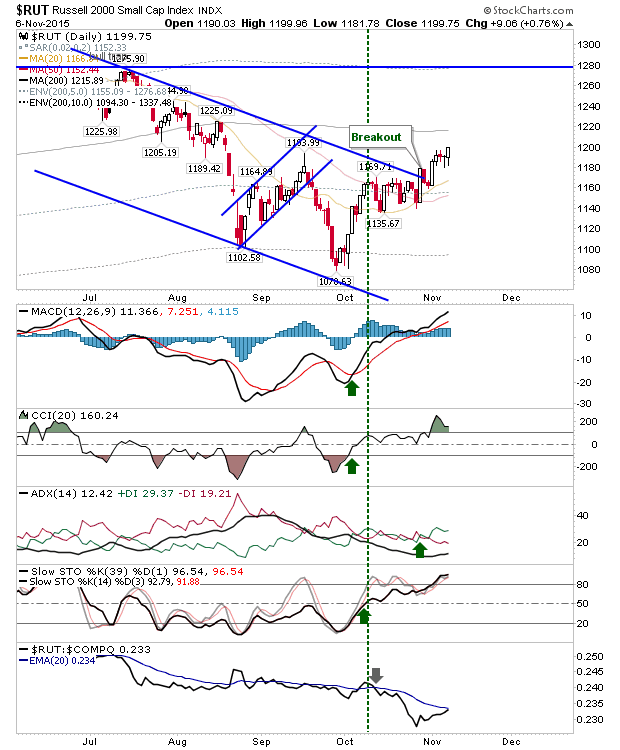

Jobs data brought with a roller coaster sell off and recovery, but by the close of business markets finished above their open price. The Russell 2000 had the best of action, continuing with its relative improvement to other indices. The 200-day MA beckons.