Bulls Keep Things Ticking Over

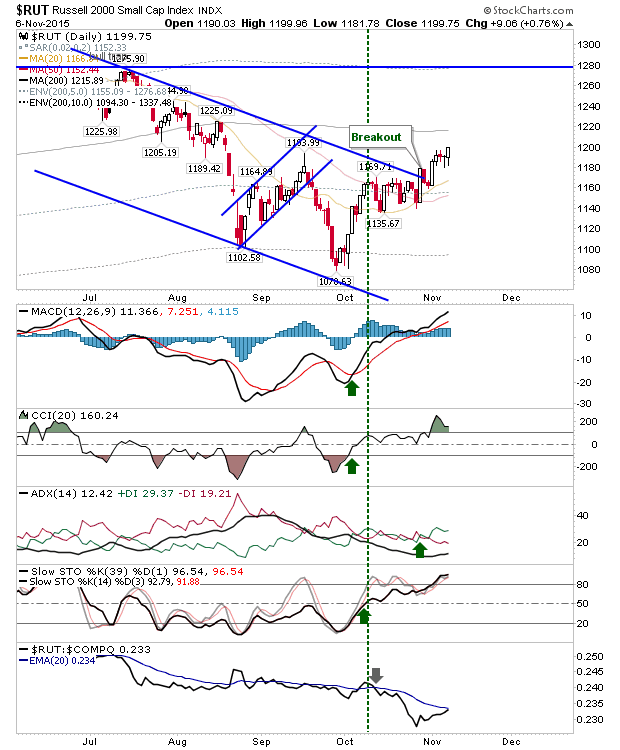

Jobs data brought with a roller coaster sell off and recovery, but by the close of business markets finished above their open price. The Russell 2000 had the best of action, continuing with its relative improvement to other indices. The 200-day MA beckons.

The Nasdaq 100 threatened a 'bull trap,' but it was able to recover breakout support by the close. Monday is nicely set for a positive start. While the MACD and relative performance (to the Russell 2000) are inching towards 'sell' triggers it will take more than a weak Monday to set these off. My short trade set up when it looked like it was going to 'bull trap' appears cooked (holding until we see a new high).

The S&P probably had the quietest of the action. Friday's action finished with a doji, but it was the only index to close with a loss (small though it was). The higher volume may suggest distribution, but I would look for a more substantial point loss on Monday to confirm this. What is more bearish are the confirmed 'sell' triggers for On-Balance-Volume and relative performance to the Russell 2000. The 20-day MA looks ready to 'bull cross' the 200-day MA for a tick in the bull column.

The Nasdaq had a quietly effective Friday. It closed with a higher close, just shy of resistance. Better still, it reversed Thursday's 'sell' trigger in On-Balance-Volume.

Market breadth is getting interesting for the Nasdaq. The Percentage of Nasdaq Stocks above the 50-day MA broke through declining resistance from 2014. Meanwhile, the Summation Index is approaching similar declining resistance; can it power through as happened for the Percentage of Nasdaq Stocks above the 50-day MA?

For Monday, look for a continuation of Friday's strong finish. The Nasdaq 100 could reward breakout buyers and further punish shorts. The patient Long can stick with the Russell 2000. Not much for Shorts unless there is a weak pre-market. If the latter does occur then watch for a return of the 'bull trap' in the Nasdaq 100.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The Nasdaq 100 threatened a 'bull trap,' but it was able to recover breakout support by the close. Monday is nicely set for a positive start. While the MACD and relative performance (to the Russell 2000) are inching towards 'sell' triggers it will take more than a weak Monday to set these off. My short trade set up when it looked like it was going to 'bull trap' appears cooked (holding until we see a new high).

The S&P probably had the quietest of the action. Friday's action finished with a doji, but it was the only index to close with a loss (small though it was). The higher volume may suggest distribution, but I would look for a more substantial point loss on Monday to confirm this. What is more bearish are the confirmed 'sell' triggers for On-Balance-Volume and relative performance to the Russell 2000. The 20-day MA looks ready to 'bull cross' the 200-day MA for a tick in the bull column.

The Nasdaq had a quietly effective Friday. It closed with a higher close, just shy of resistance. Better still, it reversed Thursday's 'sell' trigger in On-Balance-Volume.

Market breadth is getting interesting for the Nasdaq. The Percentage of Nasdaq Stocks above the 50-day MA broke through declining resistance from 2014. Meanwhile, the Summation Index is approaching similar declining resistance; can it power through as happened for the Percentage of Nasdaq Stocks above the 50-day MA?

For Monday, look for a continuation of Friday's strong finish. The Nasdaq 100 could reward breakout buyers and further punish shorts. The patient Long can stick with the Russell 2000. Not much for Shorts unless there is a weak pre-market. If the latter does occur then watch for a return of the 'bull trap' in the Nasdaq 100.

You've now read my opinion, next read Douglas' and Jani's.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday's at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil - all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!