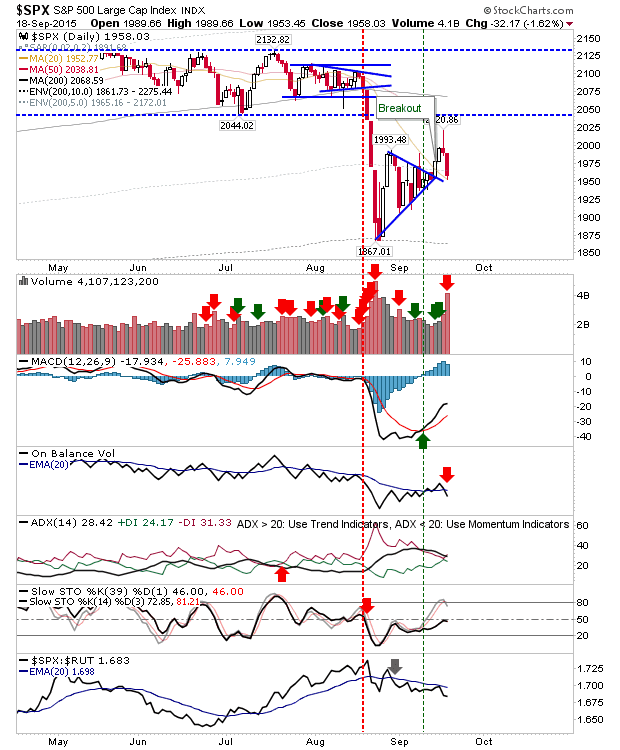

Market Indecision

It was a mixed day for markets. Bulls will take heart there wasn't an immediate follow through lower as Friday's selling had looked to suggest. Bears will still consider it a favourable market, but will need a more decisive sell off to break the support which remains. The S&P is delicately poised. A loss of 1,956 will open thing up and should quickly offer a retest of 1.867. Today's volume was very light, but enough to maintain the 'sell' trigger in On-Balance-Volume.