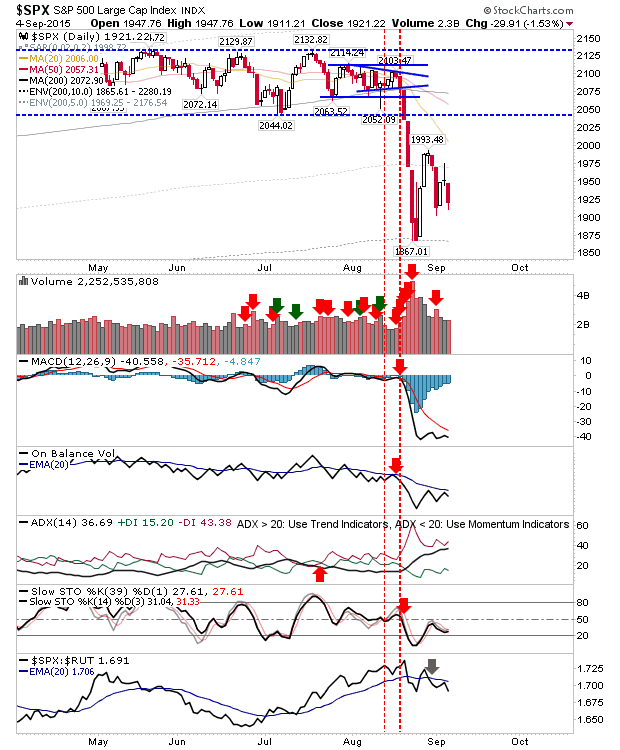

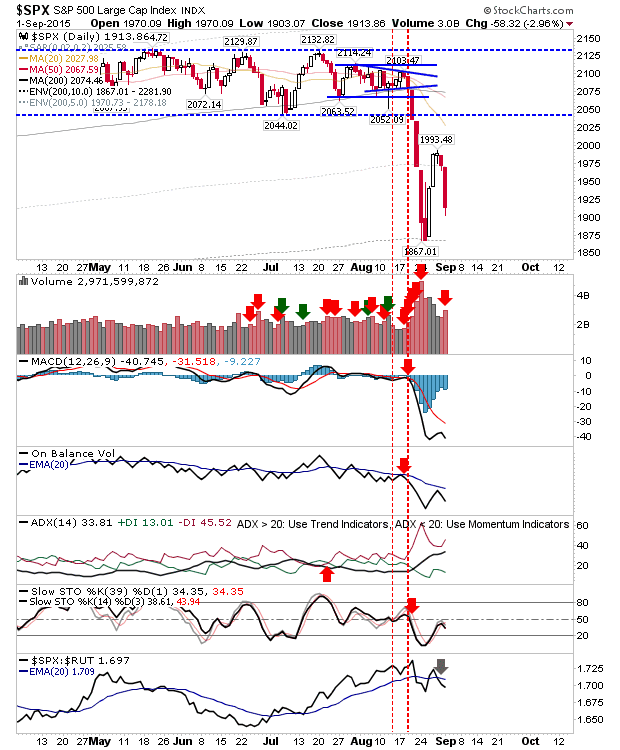

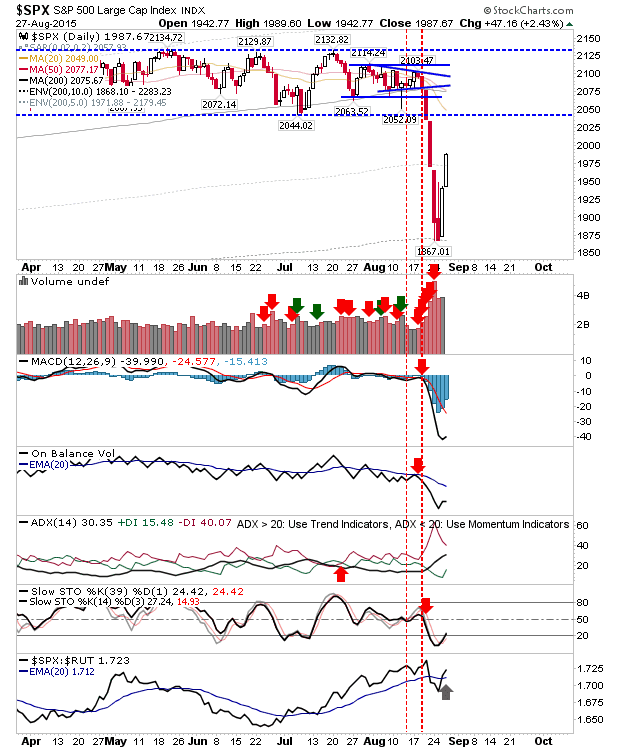

S&P and Dow Coiling

The S&P and Dow Jones is tightening into a coil, and coils typical lead to big reactions. It could be a few days before the coil is tight enough to spring, but both markets are consolidating on declining volume. However, the Dow edges in favour of bears with some distribution days in the mix, although it's countered by a MACD trigger 'buy'.