Tech Indices Breakout

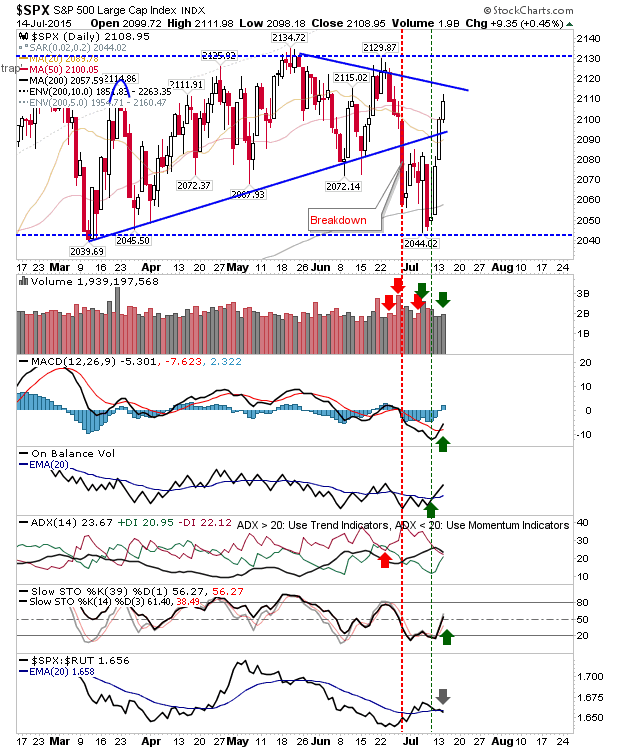

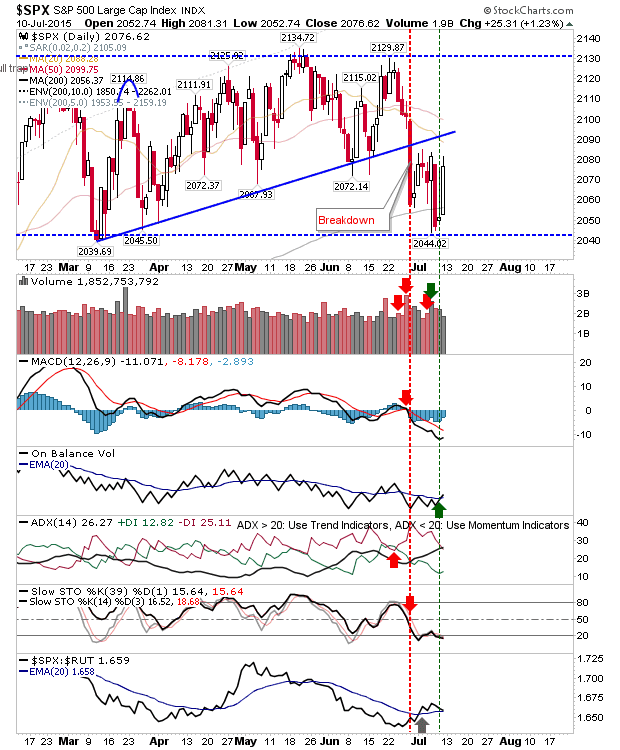

Netflix and Google offered the juice to drive the Nasdaq and Nasdaq 100 to new highs. Other indices aren't there yet, and it remains to be seen what they can offer. Friday's finish in the S&P left it just below resistance near 2,130. Technicals are net positive, and whatever bearish connotations were there from the loss of 2,080 have been firmly put to bed. Friday's doji marks indecision on the part of bulls and bears, with Large Cap traders looking at whether Tech indices can hang on.