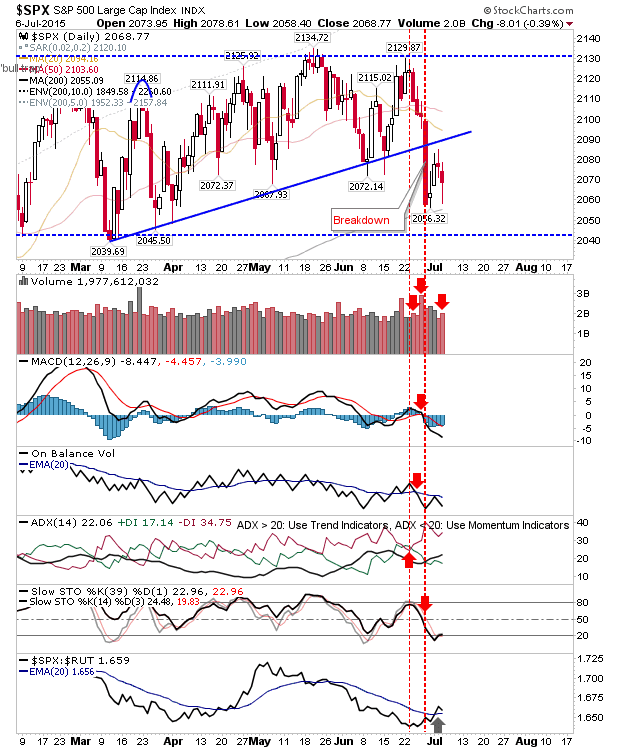

Losses Maintained

The back and forth continued, except this time pre-market gains could not be held and markets revisited lows. This lows still hold as support, but it's a tough sell to buyers to want to jump in here. The S&P finished below it 200-day MA with a big inverse hammer. Technicals are net bearish, except today's action hasn't reversed the net out performance of the Large Caps over Small Caps.