Have a Great Christmas and New Year! Small Caps - It's Over To You....

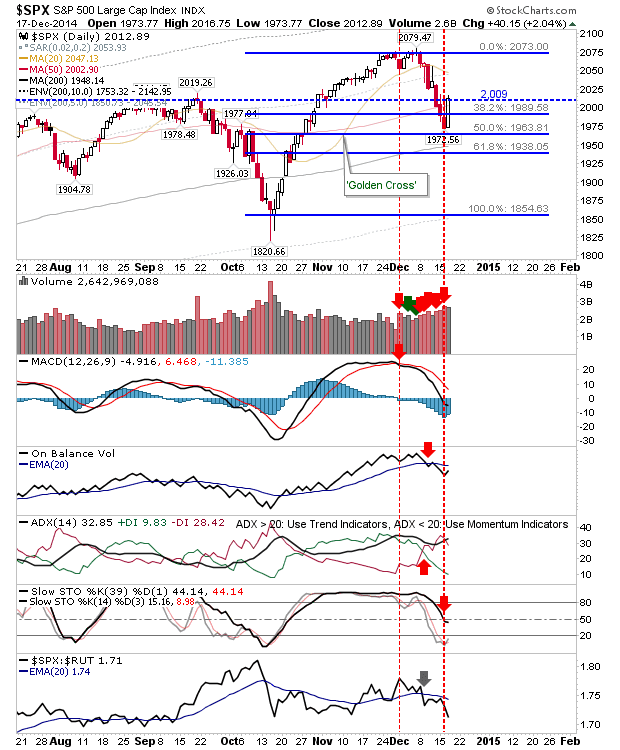

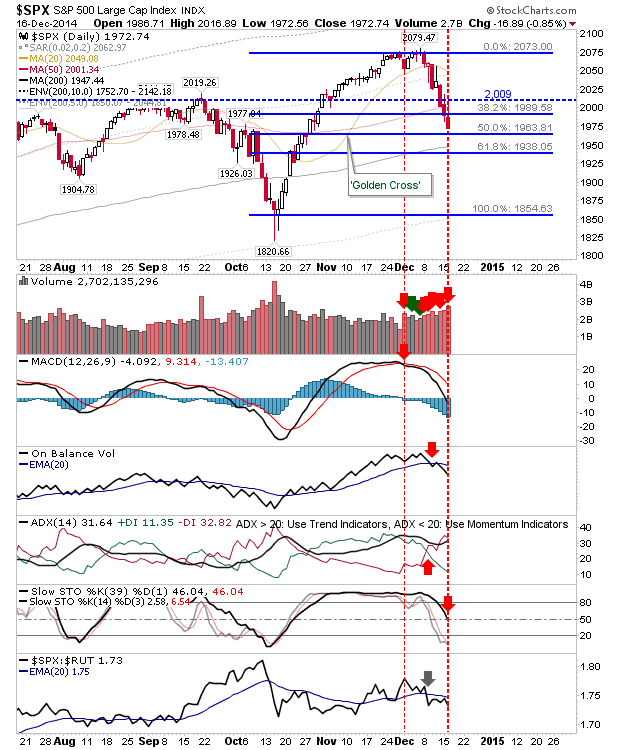

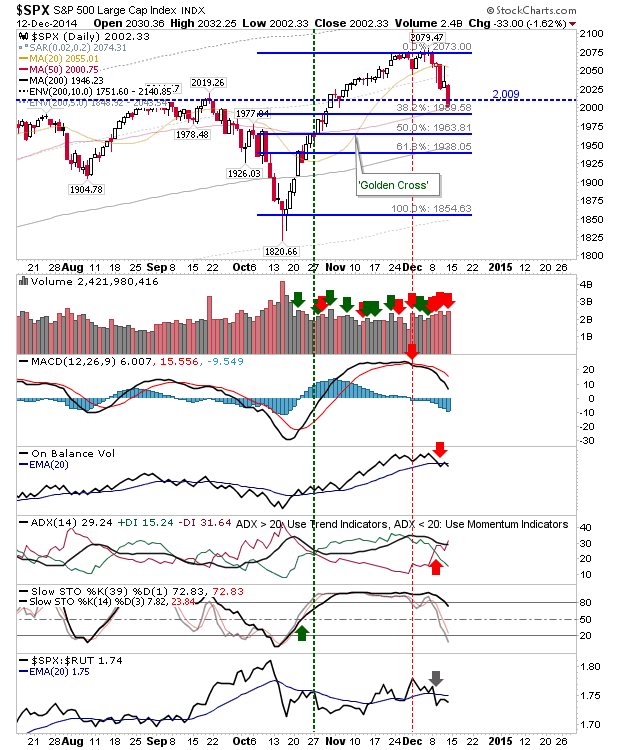

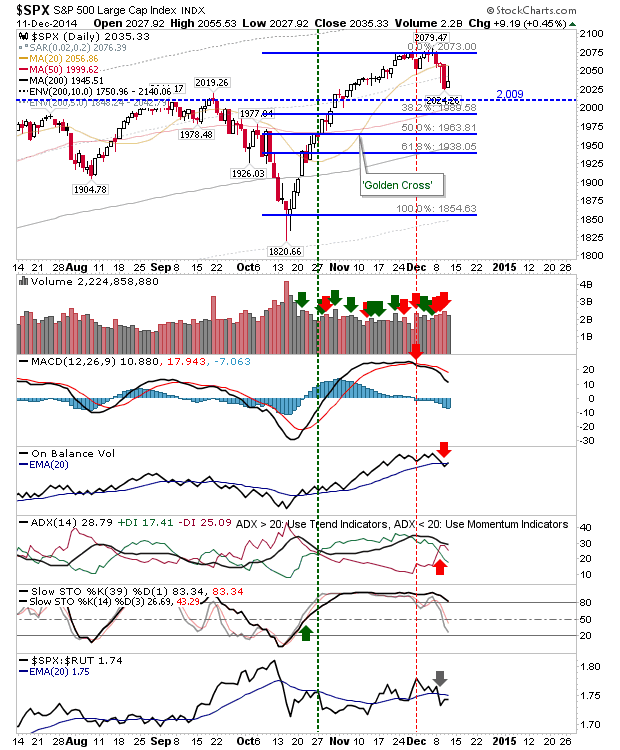

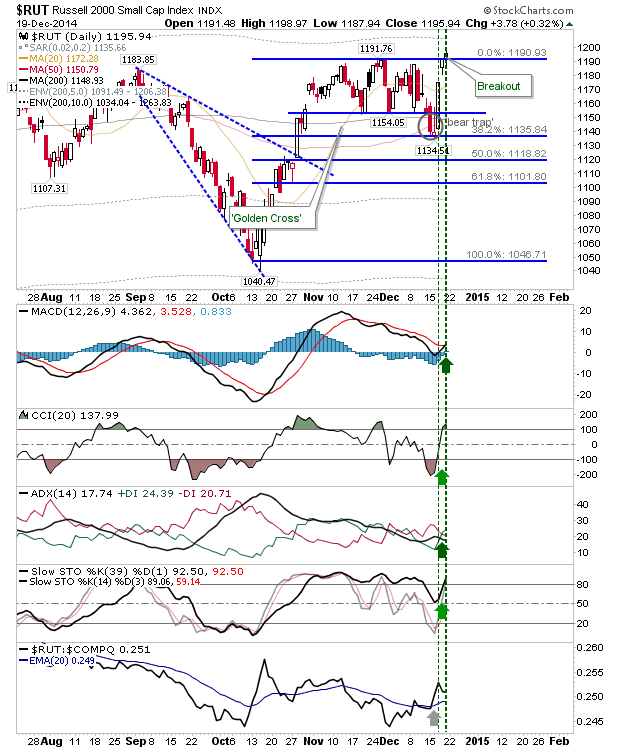

I will be keeping posts to a minimum until the New Year. Friday finished with a bit of a high volume flourish, which added a nice gloss to Thursday's big gains. The Russell 2000 managed to go one step further with a breakout. Watch this index over the coming days; if it can hold the move it will bring other indices with it. The Russell 2000 has under-performed (relatively) all year, and if bulls are to maintain a broader market rally into a sixth year then the Russell 2000 will have to do most of the leg work. As an important side note, the Russell 2000 turned net bullish technically. The flip-side is to watch for a 'bull trap', but even here, this might instead widen the recent trading range handle as major resistance lives at 1,210/15 not at 1,190.