Late Selling Puts Pressure on Friday

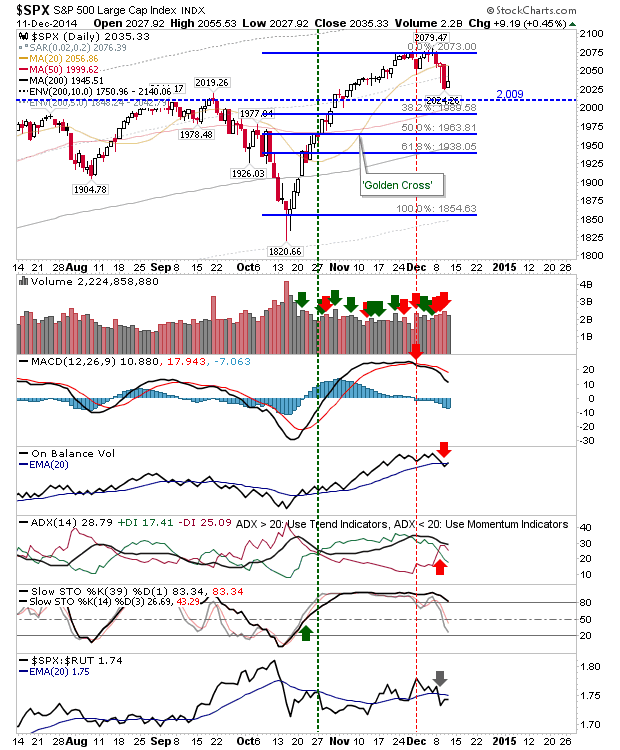

Thursday saw another attempt by bulls to make up the losses of the previous day, but bears didn't wait until the next day to attack. Instead, an afternoon assault pushed markets back towards their lows, setting up a situation for further losses today (Friday).

Volume was light, and there is plenty of support nearby to work, but it doesn't look good if you want to be a buyer for the longer term. If that's your goal, refer to my table below to identify market conditions best suited to do this.

As for markets, the S&P inverse hammer looks ugly. A test of 2,009 today or Monday doesn't look unreasonable.

The Nasdaq has rewarded shorts who attacked the 'bear flag' breakdown quite handsomely. More to follow today? The inside day looks like a bullish harami doji (one of the most reliable reversal patterns), but as the index is not oversold I would not rely on it to hold true Friday.

The Russell is range bound, and of all the indices it offers no real advantage to bull or bear.

For Friday, look for selling to continue. If markets rally, look to stand aside until they make it close to week's highs, then attack again with short positions. Any short will be negated if November swing highs are taken out.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

Volume was light, and there is plenty of support nearby to work, but it doesn't look good if you want to be a buyer for the longer term. If that's your goal, refer to my table below to identify market conditions best suited to do this.

As for markets, the S&P inverse hammer looks ugly. A test of 2,009 today or Monday doesn't look unreasonable.

The Nasdaq has rewarded shorts who attacked the 'bear flag' breakdown quite handsomely. More to follow today? The inside day looks like a bullish harami doji (one of the most reliable reversal patterns), but as the index is not oversold I would not rely on it to hold true Friday.

The Russell is range bound, and of all the indices it offers no real advantage to bull or bear.

For Friday, look for selling to continue. If markets rally, look to stand aside until they make it close to week's highs, then attack again with short positions. Any short will be negated if November swing highs are taken out.

---

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

All Contributions Welcome - Thank You!

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!