Daily Market Commentary: Bears Win

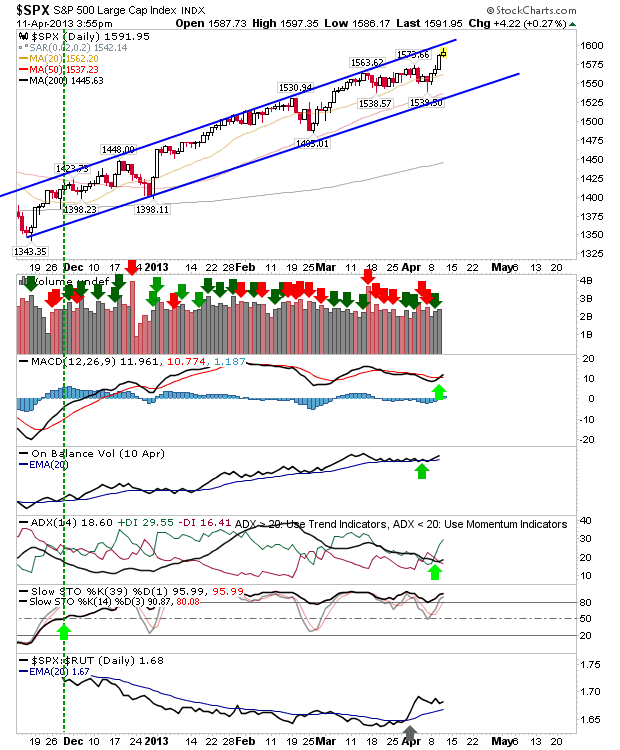

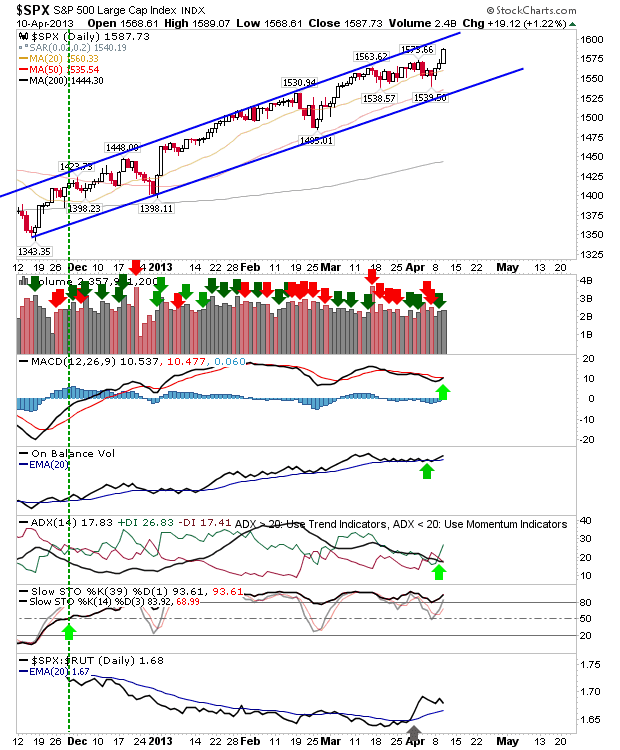

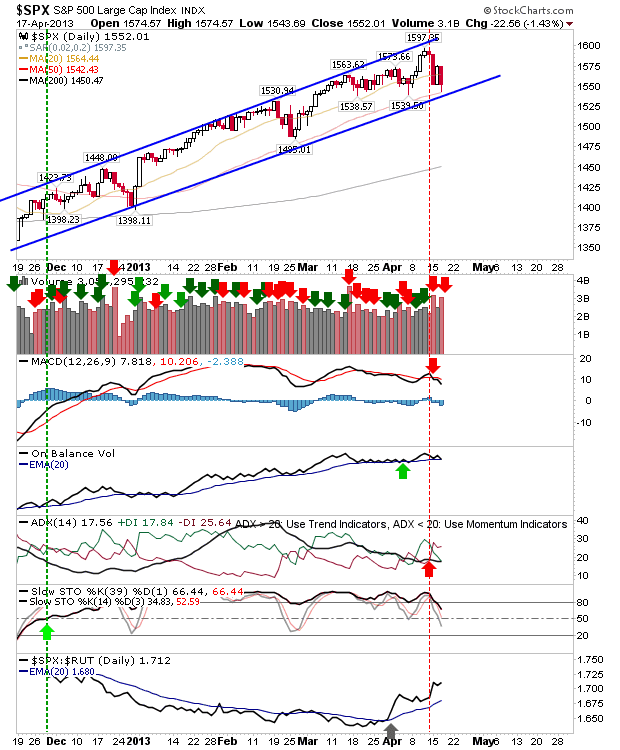

Yesterday's gains were undone by today's round of selling. Volume climbed to register a second big distribution day in three as technicals remained under pressure. This selling doesn't look done. The S&P was able to defend its 50-day MA, which is in close proximity to rising channel support. However, with similar support trashed in the Nasdaq and Russell 2000, it's going to be hard for the index to hold this support.