Daily Market Commentary: New Highs

The 'Bear Traps' are playing to form with a substantial jump to help push new market highs. Volume picked up in support with some technical improvement. Breadth is also attempting a swing low which will help support an extended rally in Tech indices.

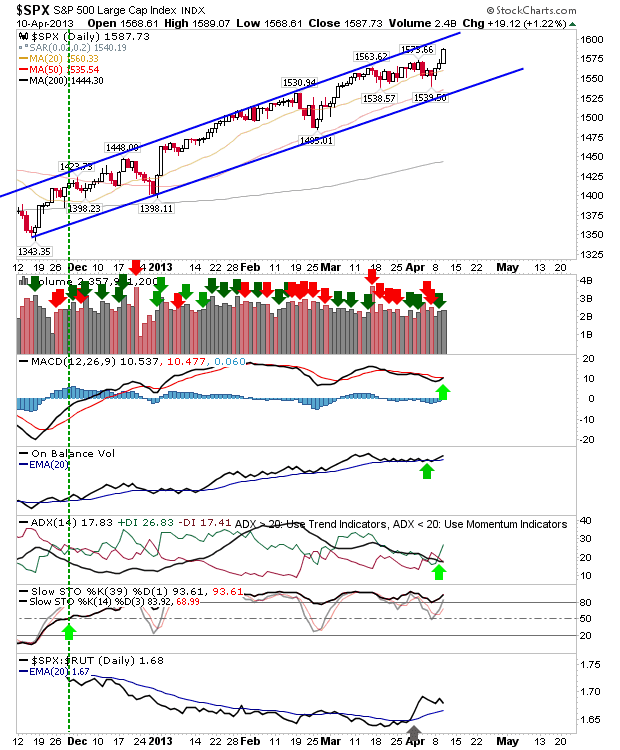

The S&P inched an accumulation day as it pushed a new high. There was also a MACD trigger 'buy' to negate what had been the only bearish indicator

The Nasdaq is stuck in a bit of a conundrum. Today's jump cleared one point of resistance, but has placed it closer to bearish wedge resistance. The MACD 'sell' trigger is still in play and the long standing relative loss to the S&P hasn't reversed (yet). Despite this, it enjoyed the strongest buying volume on the day.

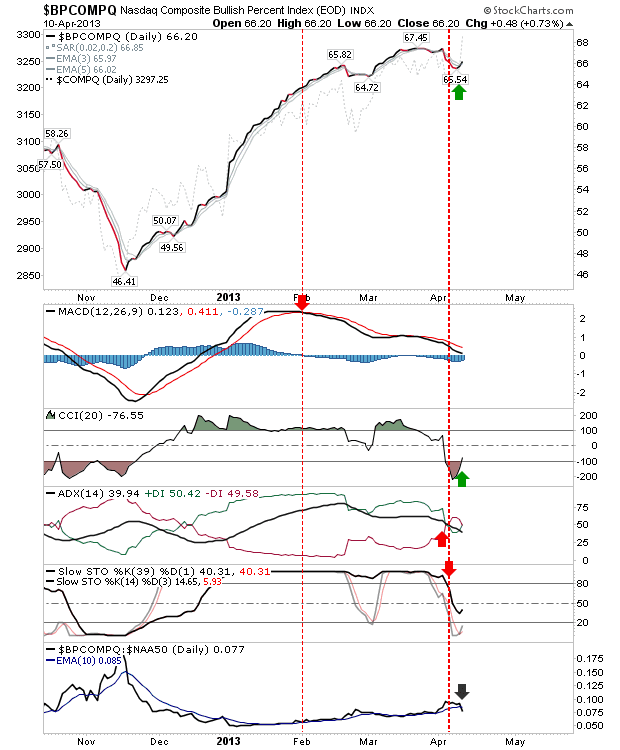

The Nasdaq Bullish Percents attempt a bottom, although its closer to overbought than oversold territory. There likely isn't much upside for this breadth indicator, but there may be enough for a 2-3 week rally.

The Percentage of Nasdaq Stocks above the 50-day MA is the most sensitive of the Breadth metrics. It jumped almost 10 percentage points; 58% of Nasdaq Stocks are now trading above their 50-day MA. However, this hasn't reversed the negative divergence in place since the start of the year. This divergence will intensify sell off days when they occur.

The Russell 2000 is working a bounce off its 50-day MA, but today's gain didn't push a new high. The relative loss to the Nasdaq is confirmed after 4 months of consistent outperformance. Small Caps are likely to consolidate from here, leaving the leadership role to Technology indices.

The Nasdaq 100 clearly shows the strength Tech enjoys with a comprehensive breakout. In addition, multiple indicators saw a recovery.

Tomorrow may see some easing after today's consolidation.It will be important for indices which have broken to new highs stay there; stops below 'bear trap' lows should be sufficient.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!

The S&P inched an accumulation day as it pushed a new high. There was also a MACD trigger 'buy' to negate what had been the only bearish indicator

The Nasdaq is stuck in a bit of a conundrum. Today's jump cleared one point of resistance, but has placed it closer to bearish wedge resistance. The MACD 'sell' trigger is still in play and the long standing relative loss to the S&P hasn't reversed (yet). Despite this, it enjoyed the strongest buying volume on the day.

The Nasdaq Bullish Percents attempt a bottom, although its closer to overbought than oversold territory. There likely isn't much upside for this breadth indicator, but there may be enough for a 2-3 week rally.

The Percentage of Nasdaq Stocks above the 50-day MA is the most sensitive of the Breadth metrics. It jumped almost 10 percentage points; 58% of Nasdaq Stocks are now trading above their 50-day MA. However, this hasn't reversed the negative divergence in place since the start of the year. This divergence will intensify sell off days when they occur.

The Russell 2000 is working a bounce off its 50-day MA, but today's gain didn't push a new high. The relative loss to the Nasdaq is confirmed after 4 months of consistent outperformance. Small Caps are likely to consolidate from here, leaving the leadership role to Technology indices.

The Nasdaq 100 clearly shows the strength Tech enjoys with a comprehensive breakout. In addition, multiple indicators saw a recovery.

Tomorrow may see some easing after today's consolidation.It will be important for indices which have broken to new highs stay there; stops below 'bear trap' lows should be sufficient.

---

Follow Me on Twitter

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com. You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY - IT'S FREE!