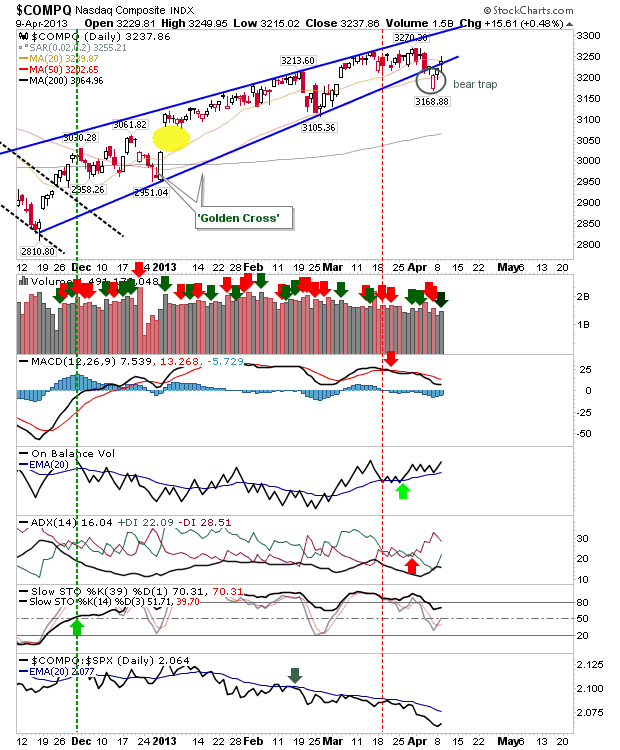

Daily Market Commentary: Bear Traps in Tech Indices

Bulls managed to mount a more substantial recovery than they have in recent days, to the extent tech indices were left with 'bear traps'. The Nasdaq finished on its 20-day MA, a potential point of attack for shorts. On-Balance-Volume has been rising, and is close to a new reaction high. Should this happen, a break of 3,270 become favoured. Other technicals remain bearish (at least for now).