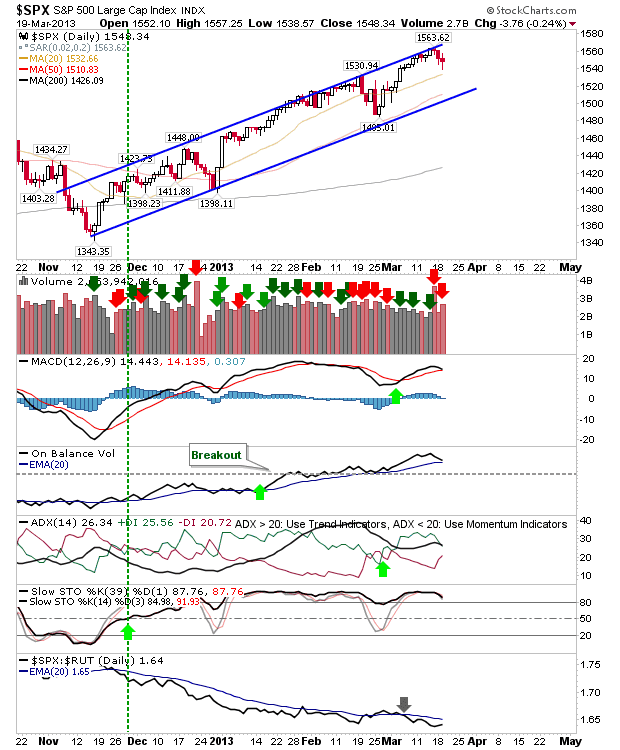

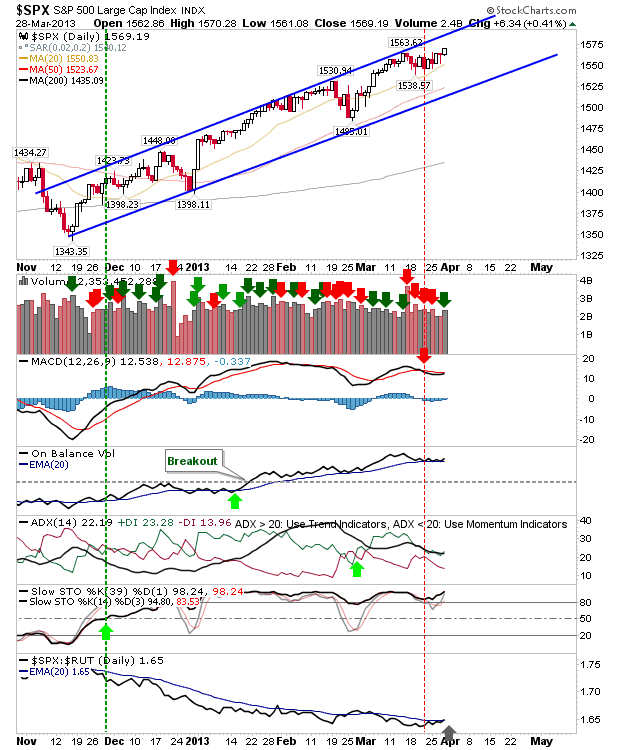

Daily Market Commentary: First Day of Accumulation In Two Weeks

It has taken a while, but bulls were finally able to turn up the pressure enough to see a higher close, on higher volume accumulation. The S&P posted a new all-time high in the process. There was also a confirmed relative swing from Small Caps to Large Cap stocks.